1. Development of China's Commodity Futures Market

Since 2010, the Chinese futures market had fast expanded with the launch of financial futures and Exchange-traded options. The derivatives market has entered a stage of comprehensive development from commodity futures to financial futures, from futures to options, from exchange-listed to OTC, and from domestic-investors-only to liberalized foreign investor trading.

Currently, China’s domestically listed futures and options cover 7 categories of finance, industrial metals, precious metals, chemicals, energy, black series and agricultural products, with a total of 91 varieties, including 64 commodity futures and 20 commodity futures options.

Figure 1 Commodity Futures and Options in China

Source: Galaxy Futures

2. Commodity Futures Market

2.1 Market expansion

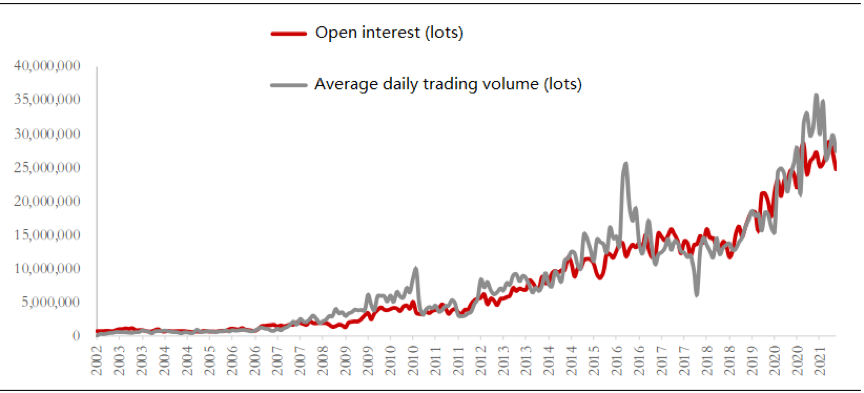

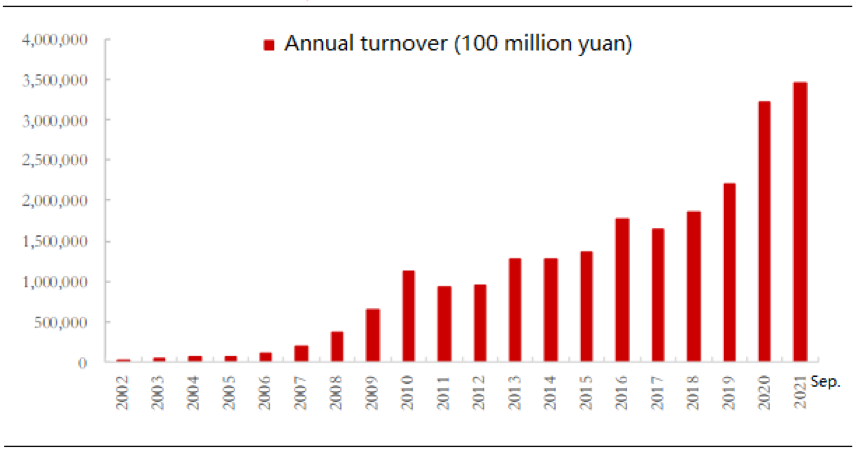

In terms of time, China's commodity futures market has continued to expand steadily, and trading volume, open interest and trading value have all shown a year-on-year growth trend for recent years. The transaction value in the first nine months of 2021 is nearly 346 trillion yuan, exceeding the level of the entire year of 2020.

Figure 2 Commodity futures and options market liquidity

Source: China Futures Association, Galaxy Futures

Figure 3 Annual turnover of commodity futures and options markets

Source: China Futures Association, Galaxy Futures

Before 2010, the commodity futures market was still in the stage of early development, and market speculation sentiment was relatively high. The ratio of overall market volume to open interest reached 2.8 at the highest point. After entering 2010, the degree of market regulation has improved. In recent years, the ratio of trading volume to open interest has gradually stabilized at around 1.

Figure 4 Commodity futures market speculation

Source: China Futures Association, Galaxy Futures

2.2 Performance of different products

This year, in the context of "carbon neutral" campaign, the commodity futures market has performed very well. In the past year, 37 of the 42 products tracked have received positive returns. Among them, the return of thermal coal reached 262%, including the price increase of 162% and the roll yield of 90%. In addition, the yields of ferrosilicon, coking coal, and coke have also exceeded 100%.

Figure 5 Commodity futures yield in the past year

Source: Wind, Galaxy Futures (2021/10/15)

2.3 Products Liquidity

China's commodity futures market is not only rich in products, but also has sufficient overall liquidity. Based on the data after the market close of 2021/10/15, there are 11 products with a holding amount of more than 50 billion for market value. They are CU-Shanghai copper, RB-rebar, Au-gold, M-soybean meal, Y-soybean oil, CF-cotton, I-iron ore, TA-PTA, AL-Shanghai aluminum, P-palm oil and MA-methanol.

Figure 6 Commodity futures market value scale

Source: Wind, Galaxy Futures (2021/10/15)

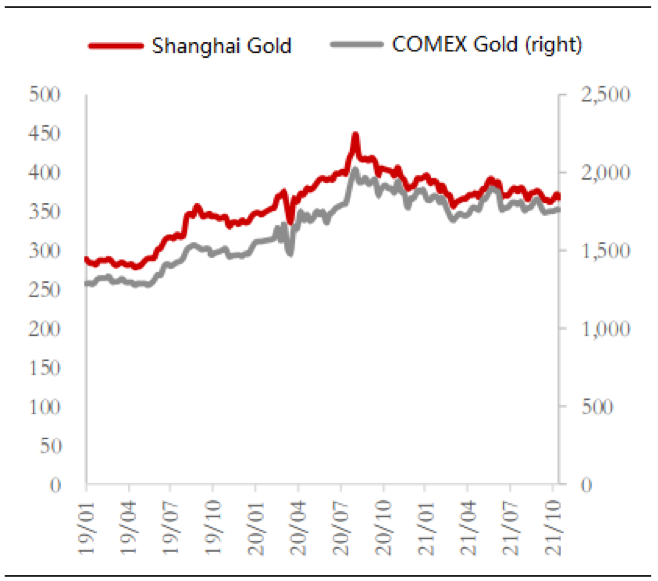

Some products of precious metals, industrial metals, and energy have the same counterparts in overseas markets, and there is a strong price correlation between domestic and foreign market products. Some varieties of precious metals, industrial metals, and energy have the same counterparts in overseas markets, and there is a strong correlation between domestic and foreign market varieties. If the exchange rate factor is not taken into consideration, the correlation coefficient between Shanghai gold and COMEX gold is 0.75, and the correlation coefficient between SC crude oil and Brent crude oil is 0.71.

Figure 7 Gold prices in domestic and foreign markets

Source: Wind, Galaxy Futures (2021/10/15)

Figure 8 Crude oil prices in domestic and foreign markets

Source: Wind, Galaxy Futures (2021/10/15)

For agricultural products and chemicals, there are more liquid products in the Chinese market, and there are many products with excellent liquidity. According to the trading volume data calculated by the American Futures Industry Association (FIA), Chinese products dominated the top 10 global agricultural futures, and five products are also listed in the energy category.

Figure 9 2020 Global agricultural futures contract trading volume ranking

|

Rank |

Products |

Exchange |

|

1 |

Soybean Meal |

DCE |

|

2 |

RBD Palm Olein |

DCE |

|

3 |

Corn |

DCE |

|

4 |

Soybean Oil |

DCE |

|

5 |

Rapeseed Meal |

ZCE |

|

6 |

Egg |

DCE |

|

7 |

White Sugar |

ZCE |

|

8 |

Cotton No.1 |

ZCE |

|

9 |

Rapeseed Oil |

ZCE |

|

10 |

Natural Rubber |

SHFE |

Source: FIA, Galaxy Futures

Figure 10 2020 Global energy futures contract trading volume ranking

|

Rank |

Products |

Exchange |

|

1 |

Brent Crude Oil |

Moscow Exchange |

|

2 |

Fuel Oil |

SHFE |

|

3 |

WTI |

Nymex |

|

4 |

Brent Crude Oil |

ICE |

|

5 |

Bitumen |

SHFE |

|

6 |

Natural Gas |

Nymex |

|

7 |

Diesel Fuel |

ICE |

|

8 |

Thermal Coal |

ZCE |

|

9 |

Coking Coal |

DCE |

|

10 |

WTI |

ICE |

Source: FIA, Galaxy Futures

2.4 Product roll features

The rollover rules of Chinese futures products are different from those of overseas products. For a long period of time, the rollover rule of 1,5,9(Jan,May,Sep) contracts has been formed in China. This pattern is also the most common main contract switching method among domestic futures products, and it is more common in agricultural products, chemicals and black series. The main contracts for the two steel products of rebar and hot-rolled coil are generally 1,5,10. The precious metal gold and silver futures products in June and December are generally the main contracts, and the rotation frequency of the main contracts is the lowest among domestic products. The non-ferrous metals such as Shanghai Aluminum, Shanghai Copper, and Shanghai Zinc have formed a monthly rollover pattern. In addition, Crude Oil and Shanghai Nickel have gradually changed to monthly rollover from the previous 1, 5, and 9 pattern.

Figure 11 The rollover rule of Chinese commodity products

|

Products |

Listing Contract |

Historical active contract |

|

Silver |

1,2,3,4,5,6,7,8,9,10,11,12 |

2,6,12 |

|

Aluminum |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,2,3,4,5,6,7,8,9,10,11,12 |

|

Apple |

1,3,5,10,11,12 |

1,5,10 |

|

Gold |

Contracts for the last three consecutive months and even-month contracts within the last 13 months |

6,12 |

|

Bitumen |

Within 24 months, the nearest 1 to 6 months are consecutive monthly contracts, and after 6 months are quarterly contracts |

1,6,9,12 |

|

Corn |

1,3,5,7,9,11 |

1,5,9 |

|

Cotton No.1 |

1,3,5,7,9,11 |

1,5,9 |

|

Copper (BC) |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,2,3,4,5,6,7,8,9,10,11,12 |

|

Glass |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,5,6,9 |

|

Fuel Oil |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,3,4,5,9,10,11,12 |

|

Hot Rolled Coils |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,5,10 |

|

Iron Ore |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,5,9 |

|

Coke |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,5,9 |

|

Egg |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,5,6,7,9 |

|

Coking Coal |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,5,9 |

|

LLDPE (Linear Low Density Polyethylene) |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,5,9 |

|

Soybean Meal |

1,3,5,7,8,9,11,12 |

1,5,9 |

|

Methanol |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,5,6,9 |

|

Nickel |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,2,3,4,5,6,7,8,9,10,11,12 |

|

Rapeseed Oil |

1,3,5,7,9,11 |

1,5,9 |

|

RBD Palm Olein |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,5,9 |

|

PP (Polypropylene) |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,5,9 |

|

Steel Rebar |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,5,10 |

|

Rapeseed Meal |

1,3,5,7,8,9,11 |

1,5,9 |

|

Natural Rubber |

1,3,4,5,6,7,8,9,10,11 |

1,5,9 |

|

LSFO (LU) |

The most recent 1 to 12 months are consecutive months and the following eight quarter months |

1,2,3,4,5,6,7,8,9,10,11,12 |

|

White Sugar |

1,3,5,7,9,11 |

1,5,9 |

|

PTA |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,5,9 |

|

PVC |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,5,9 |

|

Soybean Oil |

1,3,5,7,8,9,11,12 |

1,5,9 |

|

Thermal Coal |

1,2,3,4,5,6,7,8,9,10,11,12 |

1,5,9,11 |

Source: Wind, Galaxy Futures

3. Commodity options products

Compared with the commodity futures market, China's commodity options market started late. On March 31, 2017, the first commodity option-soybean meal option was listed on the Dalian Commodity Exchange. At present, there are a total of 20 commodity futures options. Compared with the futures market, the options market is currently slightly less liquid, with a total turnover of 24 billion yuan during September 2021, of which iron ore options with the largest turnover amounted to 3.927 billion yuan.

Figure 12 Commodity options turnover (September 2021)

Source: FIA, Galaxy Futures

4. The process of opening up the commodity futures market

In the context of the continuous opening of the domestic capital market, the China futures market had moved from pilot projects on a few products to full opening up.

On March 26, 2018, crude oil futures were officially listed for trading at the Shanghai International Energy Exchange Center. This is China's first futures product that allows foreign investors to directly participate.

Subsequently on 2018/5/4, 2018/9/21, 2019/8/12, 2020/6/22, 2020/10/23, 2020/12/22, successively launched iron ore futures, PTA futures, TSR 20 Futures, LSFO futures, Copper (BC) futures, and RBD Palm Olein futures will fully involve foreign traders, and fully introduce the participation of overseas traders.

At present, the China Securities Regulatory Commission announced that qualified foreign investors can participate in financial derivatives trading. The newly opened three categories of commodity futures, commodity options, and stock index options have been implemented since November 1, 2021. This move further liberalizes the investment scope of foreign investors.

In general, the Chinese commodity futures market currently:

1) Rich products. There are 64 types of futures and 20 types of commodity options. All kinds of industrial chains are covered, especially many black series products, energy-chemical products and agricultural products are unique in the world.

2) Sufficient liquidity. It not only covers comprehensively in the industrial chain, but also has sufficient liquidity. The holding amount of 11 products exceeds 50 billion RMB. Agricultural product futures have taken the top 10 in global trading volume ranking, and 5 energy products have also ranked among the top 10 in global energy products. And the market size is increasing year by year, and the transaction amount in the first 9 months of year 2021 has exceeded that of the whole year of year 2020.

3) Market standardization. Before 2010, there was a period of chaotic development in the futures market. After rectification, there are currently 5 commodity futures exchanges in China (Shanghai Futures Exchange, Dalian Commodity Exchange, Zhengzhou Commodity Exchange, Shanghai International Energy Exchange Center, Guangzhou Futures Exchange). The over-speculative nature of products in the market has also been significantly reduced, and the ratio of overall trading volume to open interest is currently around 1.

4) Investment Opportunities. The performance of bulk commodities for year 2021 is very strong, and the annual return rate of multiple products exceeds 100%. And under the theme of "carbon neutral" campaign, China's industrial production will undergo profound changes, and there are still many trading opportunities for commodities.