Focus on the expansion opportunity of the hot-rolled coil/rebar price spread in the contract 2501.

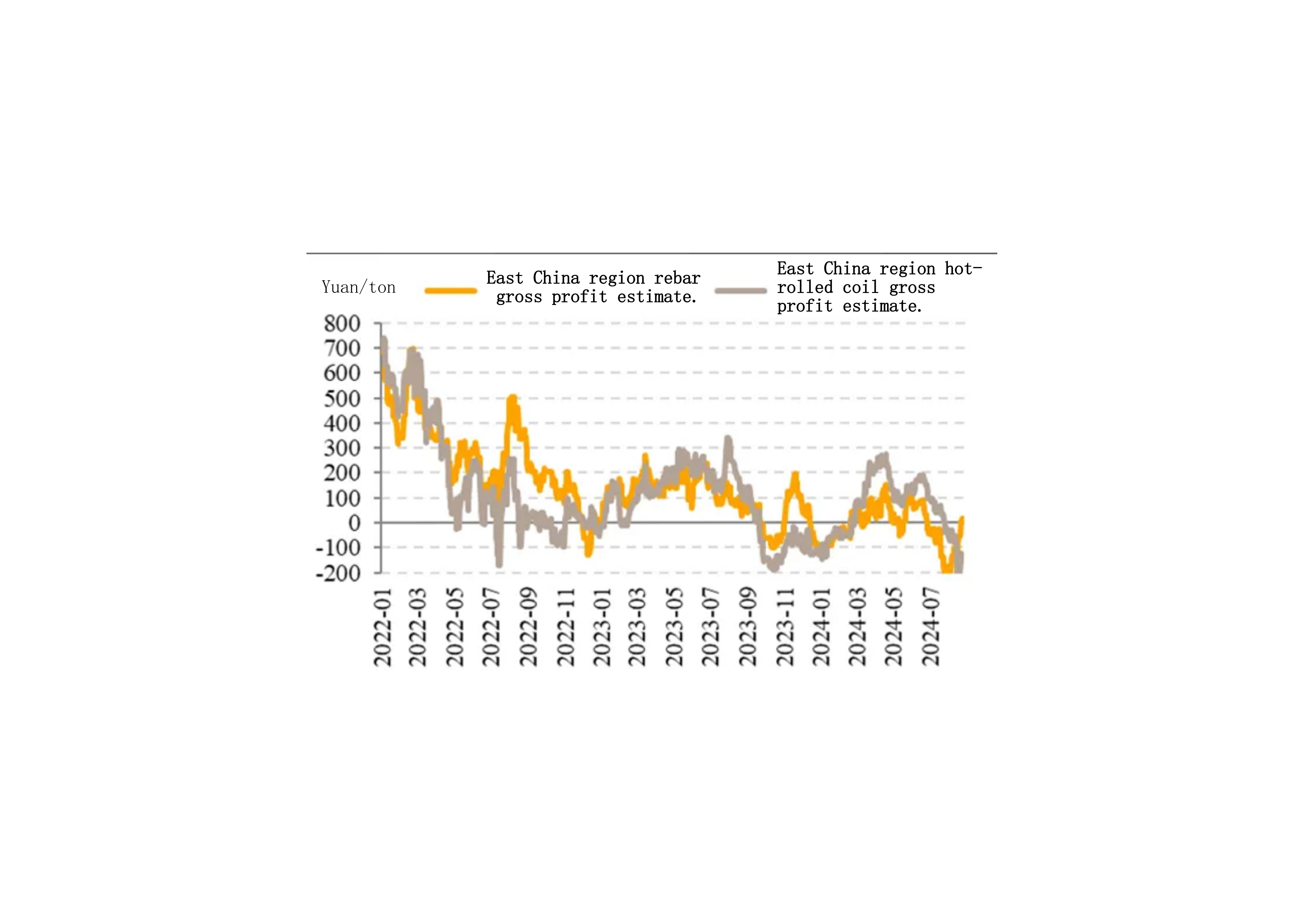

Market Status: Recently, due to the transition between new and old standards, there has been an oversupply of rebar, leading to a significant drop in prices. Production has decreased from 2.45 million tons in June to 1.61 million tons, a reduction of 34%. Meanwhile, the oversupply of hot-rolled coil has put pressure on its price, causing the hot-rolled coil/rebar price spread to contract to a lower level, with the spot price spread in the East China region even turning negative.

Potential Driving Factors:

- The impact of old-standard rebar on the market is gradually diminishing, but it still requires time to be digested.

- There is a significant difference in the steel-making profits of rebar and hot-rolled coil, indicating a trend of iron water flowing back to building materials.

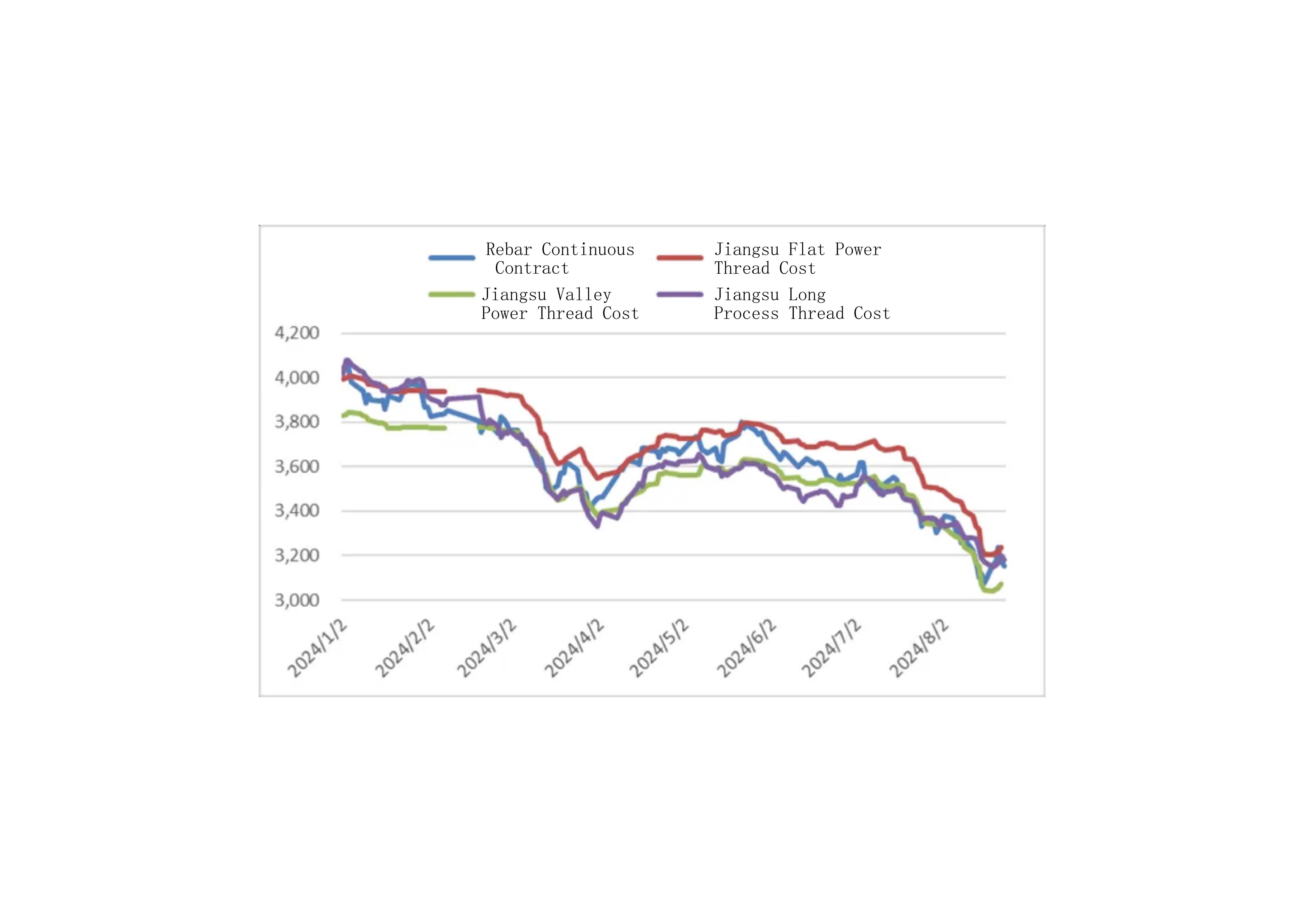

- In the bear market pattern, the cost support for plate is more solid.

Cost Analysis: The cost of electric furnace rebar and long-process rebar in the East China region is around 3,075 yuan/ton and 3,180 yuan/ton, respectively, while the cost of hot-rolled coil is about 3,275 yuan/ton, showing that the cost support for plate is relatively strong.

Export Impact: China's hot-rolled coil exports to Vietnam have been affected by anti-dumping investigations, with export volumes continuously declining since May. It is expected that the decline in export volumes will become more apparent in October, which will put pressure on the price of plate.

Strategy Suggestion: It is recommended to focus on the long hot-rolled coil and short rebar hedging strategy for the contract 2501, with the potential for the hot-rolled coil/rebar price spread to expand to around 150 yuan.

Risk Warning: A significant decline in plate exports or a significant better-than-expected demand for construction steel may affect the repair of the hot-rolled coil/rebar price spread.