(1) CFFEX's new regulations prohibit the reduction of high-frequency trading fees, which will be implemented from now on;

(2) The measures for handling violations are published together to reflect strict supervision.

On January 7, CFFEX announced on its official website that the Settlement Rules of the China Financial Futures Exchange (Revised Edition) and the Measures for Handling Violations and Defaults of the China Financial Futures Exchange (Revised Edition) have been reported to the China Securities Regulatory Commission (CSRC) and are hereby released. The new regulations will come into effect on January 7, 2025.

In the eyes of the industry, this move is also in response to the regulatory requirements for "reducing the frequency and speed of high-frequency trading", and the supervision confirms the high-frequency trading fees in the form of regulations, and adds the illegal treatment method of "not standardizing the use of the transaction fees reduced by the exchange".

关于修订《中国金融期货交易所结算细则》《中国金融期货交易所违规违约处理办法》的通知| 中国金融期货交易所

For high-frequency trading, irregularities will be penalized

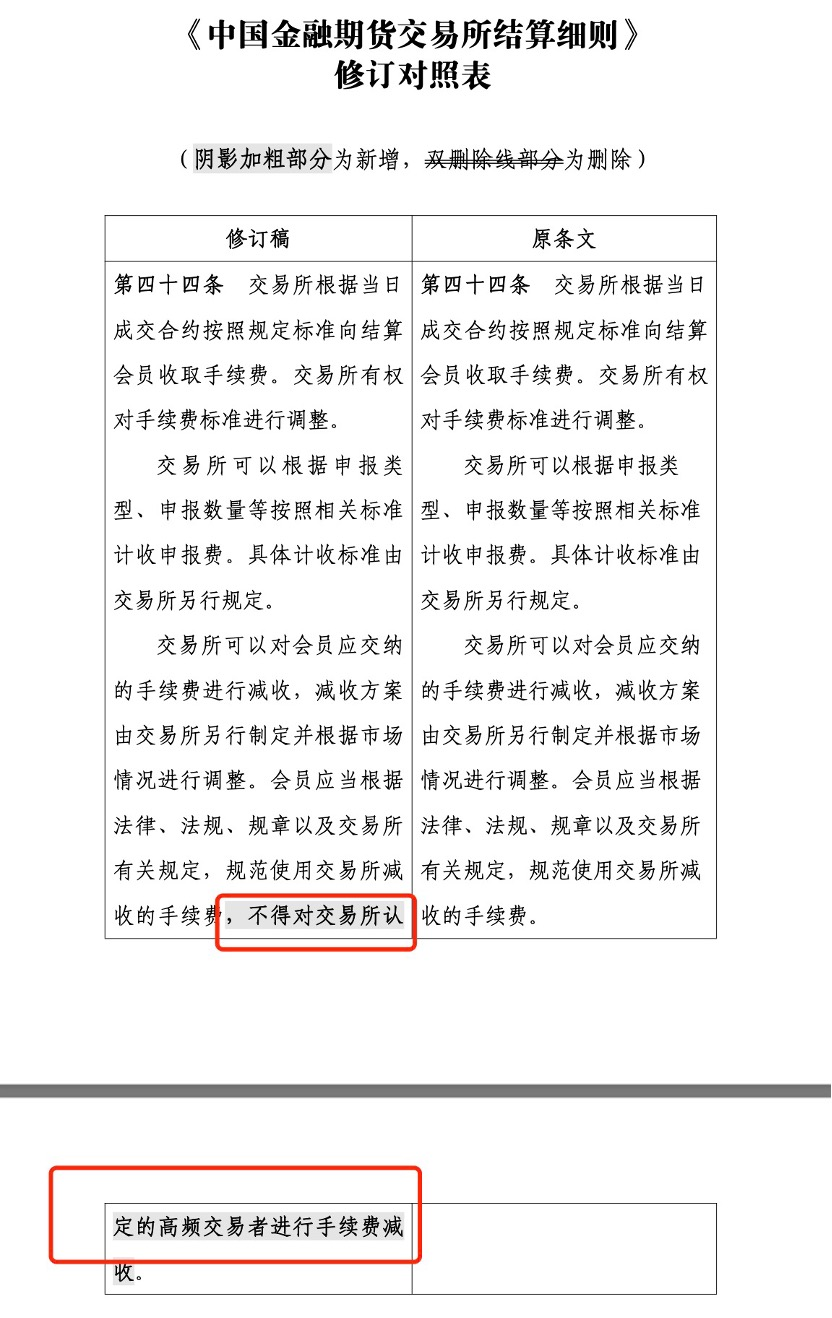

In accordance with the requirements of the revised Settlement Rules of the China Financial Futures Exchange and the Measures for Handling Violations and Defaults of the China Financial Futures Exchange, the use of the transaction fee reduced by the exchange shall be regulated, and the handling fee shall not be reduced for high-frequency traders identified by the exchange.

|

《Settlement Rules of China Financial Futures Exchange》 |

|

|

(The bold part of the shadow is new, and the double strikethrough part is deleted) |

|

|

Revisions |

Original Provisions |

|

Article 44 The Exchange shall charge the Clearing Members a handling fee according to the prescribed standard for the contracts traded on the same day. The transaction has the right to adjust the fee standard. |

Article 44 The Exchange shall charge the Clearing Members a handling fee according to the prescribed standard for the contracts traded on the same day. The transaction has the right to adjust the fee standard. |

At the same time, CFFEX has added penalties for "failure to standardize the use of transaction fees reduced", that is, to order corrections and confiscate illegal gains.

In addition, depending on the severity of the circumstances, the exchange may also impose disciplinary sanctions such as warning, circulating criticism, public reprimand, restricting the opening of positions for less than 12 months, forced liquidation, suspension or restriction of business, adjustment or cancellation of membership, and declaration as a "prohibited market entrant".

In terms of fines, if there is no illegal income or the illegal income is less than 100,000 yuan, punitive liquidated damages of less than 500,000 yuan may be charged; Where the illegal income is more than 100,000 yuan, punitive liquidated damages of between 1 and 5 times the illegal income may be collected.

In July 2024, the China Securities Regulatory Commission (CSRC) issued a document stating that it will continue to strengthen the monitoring of programmatic transactions, promote the frequency and speed reduction of high-frequency trading, and study and clarify the standards for additional traffic fees and order cancellation fees for high-frequency quantitative transactions. Since then, from the exchange level, futures have opened the "frequency reduction and speed reduction" mode at high frequency.

In July last year, it was reported that the optical fiber from domestic futures companies to the counters of major futures exchanges was extended by 30 kilometers. A number of futures companies learned of the transaction delay through their own calculations, but many futures companies said that they had not been notified in advance.

After the transaction slowdown, Guangzhou Futures Exchange, DCE, Zheng Commercial Exchange, Shanghai Futures Exchange and Shanghai Futures Exchange all issued notices related to filing fees. Taking the Guangzhou Futures Exchange as an example, starting from October 25, 2024, it will charge a filing fee for the trading of industrial silicon futures, industrial silicon options, lithium carbonate futures and lithium carbonate options. ZCE charges a declaration fee for the trading of 18 futures varieties such as cotton futures, glass futures and soda ash futures and 18 options such as sugar options, cotton options and PTA options.

From the perspective of the industry, the adjustment of the declaration fee for some varieties will increase the transaction cost of some high-frequency trading investors. This move has also been interpreted as a sword against high-frequency quantitative trading.

There was a precedent for the penalty for high-frequency trading in futures last year

There is a precedent for penalties for violations of high-frequency trading in futures. On February 28, 2024, CFFEX announced that it would impose disciplinary sanctions on Shanghai Weiwan Private Equity Fund Management Co., Ltd. and its actual controller for failing to declare the accounts with actual control relationships as required, violating the exchange trading quota system, and trading beyond the trading limit on multiple stock index futures products.

According to CFFEX, during the period of failing to declare the actual control relationship, Shanghai Weiwan Company and its actual controller used high-frequency trading methods to trade beyond the trading limit on a number of stock index futures products, which was serious, constituting an illegal act of "using improper means to circumvent the exchange trading limit system and trading beyond the limit", and obtained an illegal profit of 8.9348 million yuan.

On the same day, a spokesperson for the China Securities Regulatory Commission (CSRC) immediately answered reporters' questions on the disciplinary measures taken by CFFEX.

According to the CSRC, CFFEX has taken regulatory measures against relevant customers for violating the actual control relationship account management of the futures market in accordance with regulations, which is a measure to fulfill the regulatory duties of the exchange. The China Securities Regulatory Commission (CSRC) has always adhered to the main tone of strict supervision, guided the stock exchange and the CFFEX to strengthen the linkage of futures and spot supervision, penetrated the supervision of various trading behaviors, including high-frequency trading, and severely cracked down on market violations in accordance with laws and regulations. The China Securities Regulatory Commission will continue to thoroughly implement the spirit of the Central Financial Work Conference, comprehensively strengthen supervision, and effectively ensure the stable and healthy operation of the market.

The punishment of the subject of illegal trading in the capital market reflects the "long teeth and thorns" of supervision, which is angular and angular. At the same time, CFFEX said that it will crack down on illegal acts of evading trading supervision by improper means, violating the "three publics" principle of the market, and harming the legitimate rights and interests of investors, and always maintain a strict tone and a high-pressure posture of "zero tolerance".