4.The Latest Policy Changes in China Bond Market

In the past, China had remained prudent towards opening up its financial market and sought to restrict the movement of capital in-and-out of the country that might impose potential threats to the stability of the domestic financial system. Hence, China’s bond market has been largely closed to foreign investors, resulting in the low share of foreign ownership in the domestic bond market. In recent years, China has taken steps to open up its bond market to catch up with the rapid pace of capital account liberalisation and RMB internationalisation.

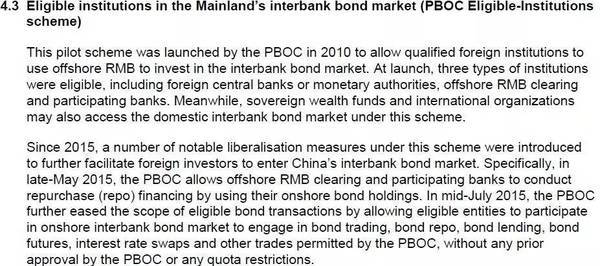

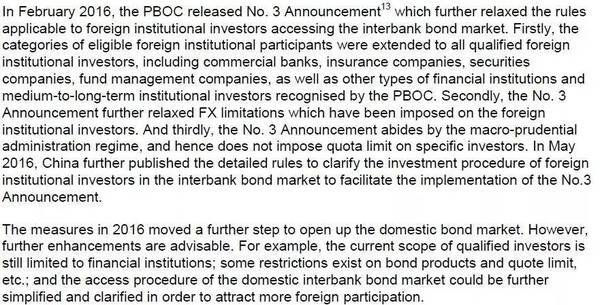

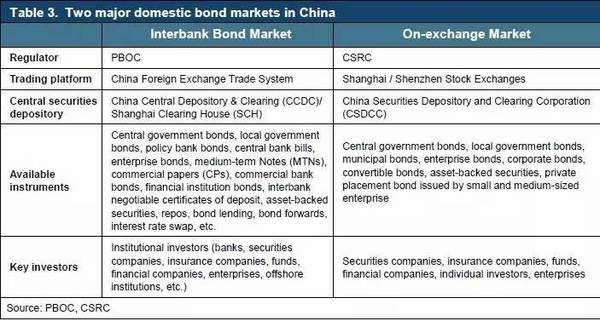

At present, China runs three main schemes that allow foreign investors to access the domestic bond market, namely the QFII, the RQFII and the PBOC Eligible-Institutions schemes, as explained below.

5.INSTITUTIONAL FEATURES THAT MAY LIMIT FOREIGN PARTICIPATION

In addition to restrictive access to the domestic market, certain instit to be addressed in order to promote more active foreign participation.

6.POSSIBLE IMPROVEMENTS

To further promote foreign participation in China’s domestic bond market, the following potential improvement could be considered: