For there’s obvious collinearity between CSI300 and SSE50, the coefficients are in a two dimensional united distribution, which formed a curved surface with the residual sum of squares.

In the previous regression, the ridge regression had been used to calculated positive coefficients of CSI300 and SSE50 with a steady ridge trace and lessened covering effect of SSE50 on CSI300, with CSI300 : SSE50 = 3:5.

Further constraints had been added to calculate small residual sum of squares and neutralized the portfolio.

The constrains are as below:( We set the data range from 2016/1/15—2016/12/30 )

Regression on these constrains:

The residual sum of squares reached the minimum when a is at 0.032.

We observed the change of RSS when a is around 3.2:

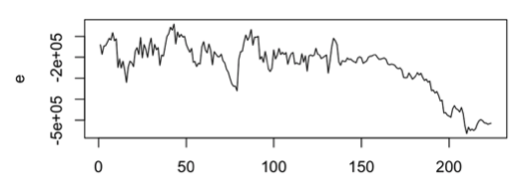

1、 e<-3*csi300+5*sse50-100*a50 (residual is negative)

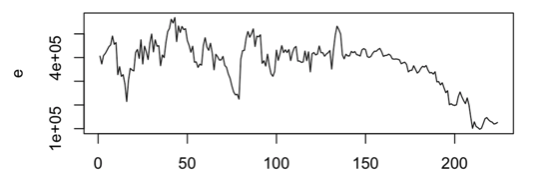

2、 e<-3.3*csi300+5.5*sse50-100*a50 (residual is positive)

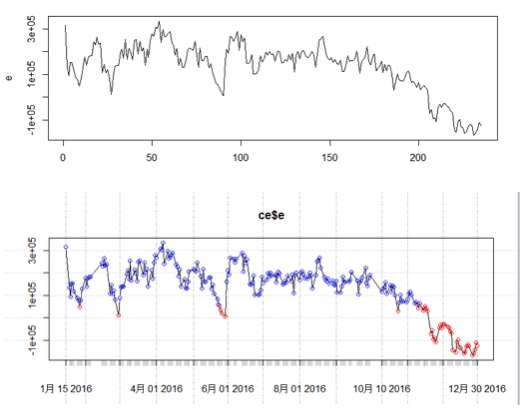

3、 e<-3.2*csi300+5.3*sse50-100*a50 (residual is neutralized)

We set coefficients for case 3 to integers by dividing 1.06:

4、e<-3*csi300+5*sse50-94*a50(residual neutralized)

Simulation trading with Average Reverse Strategy generated result with N=10, T=60:

Copyright by FangQuant.com