This weekly report is provided by Galaxy Futures on Monday morning, Beijing time. The data sources are INE, DCE, CZC, CME, ICE, and various news sources.

Please note:

1. Volume, Open Interest and turnover include buy and sell (double-side counted); 2. Volume and Open Interest are measured in lots;

3. Turnover (notional value) is measured in 10,000 yuan(RMB);

4. Price is daily/weekly last trading price.

PTA

Part A: Review (2018/11/26-2018/11/30)

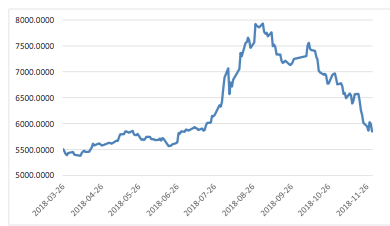

From November 26, 2018 to November 30, 2018:the closing price of the main contract (TA905 contract) of PTA futures on Friday was 5846 yuan, 168 yuan lower than the closing price of the last trading day of last week. The highest price for this week is 6044 yuan, and the lowest point is 5738 yuan.

This week (2018/11/26-2018/11/30), the total volume of the main contract was 4,166,060 lots, a decrease of 442,486 lots from last week. After the close of trading this Friday, the open interest of the main contract was 752,822 lots, a decrease of 86,462 lots from the last trading day of last week.

8,106,648 lots of China PTA futures were traded during 11/26/2018 to 11/30/2018, and the weekly turnover (notional value) was 237,893 million yuan (RMB), approximately $34.33 billion. The average daily trading volume for the current week was 1,621,330 lots/day.

Notes: The main contract refers to the futures contract with the maximum open interest.

Table:Volume, Open interest and Turnover of PTA futures

|

Category |

Current week |

Last week |

WoW Change |

|

Volume |

8,106,648 |

7,559,814 |

7.23% |

|

Open interest |

1,558,110 |

1,623,640 |

-4.04% |

|

Turnover(10,000 yuan) |

23,789,348 |

23,693,015 |

0.4066% |

Graph: Close price of TA.CZC(in CNY,2018/3/26-2018/11/30)

The last trading day for China PTA futures December 2018 contract (TA812) is December 14th, 2018 and the final delivery date is December 18th, 2018.

Part B: Market Dynamics

1. Speech by Vice Chairman Fang Xinghai at the launching ceremony of PTA Futures Internationalization

PTA futures is the first chemical product in China's futures market. Today it has become the first chemical product to introduce foreign traders. It is also the third international futures product after crude oil and iron ore futures.

Fang said that there are some differences between China's futures market rules system and international practices. Some of these are things that we should insist on, and some of which need to learn from mature markets and optimize them. In the next step, we must further enhance the inclusiveness of the specific variety rule system, improve the participation of overseas traders, and improve the quality of the opening of the futures market, while ensuring that risks are controllable. The first is to optimize the suitability system for traders of specific varieties. Simplify the requirements of available funds threshold, professional knowledge test and transaction experience, and gradually integrate and unify the appropriate variety system of each futures exchange to achieve mutual recognition. The second is to optimize the account opening process, improve the efficiency of account opening, and enhance the account opening experience. Optimize the unified account opening system in the futures market and improve technical services; Properly simplify the account opening information, cancel the account opening process that is not necessary and does not conform to the overseas cultural habits, and reduce the waiting time for opening an account. The third is to reduce institutional transaction costs. Research and improve the exchange program to reduce the exchange fee for overseas traders. Orderly expand the range of securities that can be used to cover margins, and improve the efficiency of capital use. The fourth is to coordinate foreign exchange, finance, taxation, customs and other departments, further reform and improve the relevant systems, so that more foreign traders can easily participate in China's futures market.

2. About 80 overseas traders successfully opened an account of PTA futures

On November 30th, the launching ceremony of PTA futures introduction of overseas traders was held at Zhengzhou Commodity Exchange. About 80 overseas traders successfully opened an account.

It is reported that about 80 overseas traders from 5 countries and regions including Singapore, the United Kingdom, the United Arab Emirates, Hong Kong and Taiwan have successfully opened accounts in 16 member units, of which corporate customers account for nearly 90%. In addition, Bank of China became the first foreign exchange settlement bank for PTA offshore traders.

Copy by fangquant.com