This weekly report is provided by Galaxy Futures on Monday morning, Beijing time. The data sources are INE, DCE, CZC, CME, ICE, and various news sources.

Please note:

1. Volume, Open Interest and turnover include buy and sell (double-side counted); 2. Volume and Open Interest are measured in lots;

3. Turnover (notional value) is measured in 10,000 yuan(RMB);

4. Price is daily/weekly last trading price.

PTA (Pure Terephthalic Acid)

Part A: Review (2019/1/21-2019/1/25)

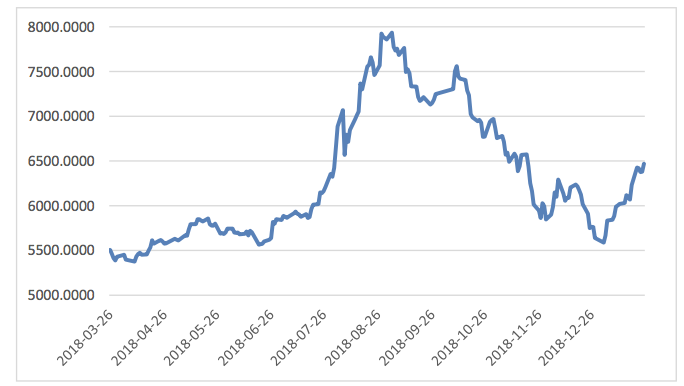

From January 21, 2019 to January 25, 2019:the closing price of the main contract (TA905 contract) of PTA futures on Friday was 6470 yuan, 238 yuan higher than the closing price of the last trading day of last week. The highest price for this week is 6572 yuan, and the lowest point is 6216 yuan.

This week (2019/1/21-2019/1/25), the total volume of the main contract was 14,609,794 lots, an increase of 4,877,832 lots from last week. After the close of trading this Friday, the open interest of the main contract was 1,064,436 lots, an increase of 22,396 lots from the last trading day of last week.

15,831,778 lots of China PTA futures were traded during 1/21/2019 to 1/25/2019, and the weekly turnover (notional value) was 506,562 million yuan (RMB), approximately $74.56 billion. The average daily trading volume for the current week was 3,166,356 lots/day.

Notes: The main contract refers to the futures contract with the maximum open interest.

Table:Volume, Open interest and Turnover of PTA futures

|

Category |

Current week |

Last week |

WoW Change |

|

Volume |

15,831,778 |

10,649,540 |

48.66% |

|

Open interest |

1,528,974 |

1,457,380 |

4.91% |

|

Turnover(10,000 yuan) |

50,656,194 |

32,313,528 |

56.76% |

Graph: Close price of TA.CZC(in CNY,2018/3/26-2019/1/25)

Graph: Sum of All PTA Future contracts (2018/10/22-2019/1/25)

Part B: Market Dynamics

In the short-term, the pressure on PTA supply and demand is not large. Although polyester plans to reduce production, it has not yet been implemented. PTA will rise under the impetus of crude oil.

In the long run, crude oil is deeply affected by geopolitical factors and is highly variable. Investors are cautious about this, and the increase in PTA prices may be limited.

Copyright by Fangquant.com