Part A: Review (Mar. 4, 19-Mar. 11, 19)

From Mar. 4, 19 to Mar. 8, 19:the closing price of the main contract of crude oil futures of INE on Friday was 437 yuan/barrel, 12.3 yuan lower than the closing price of the last trading day of last week. The highest price for this week is 447.2yuan/barrel, and the lowest point is 426.1yuan/barrel.

This week, the total volume of the main contract was 1,544,528 lots, an increase of 176,528 lots from last week. After the close of trading this Friday, the open interest of the main contract was 36,664 lots, a decrease of 5,452 lots from the last trading day of last week.

Notes: The main contract refers to the futures contract with the maximum open interest. Part B: Transaction Summary

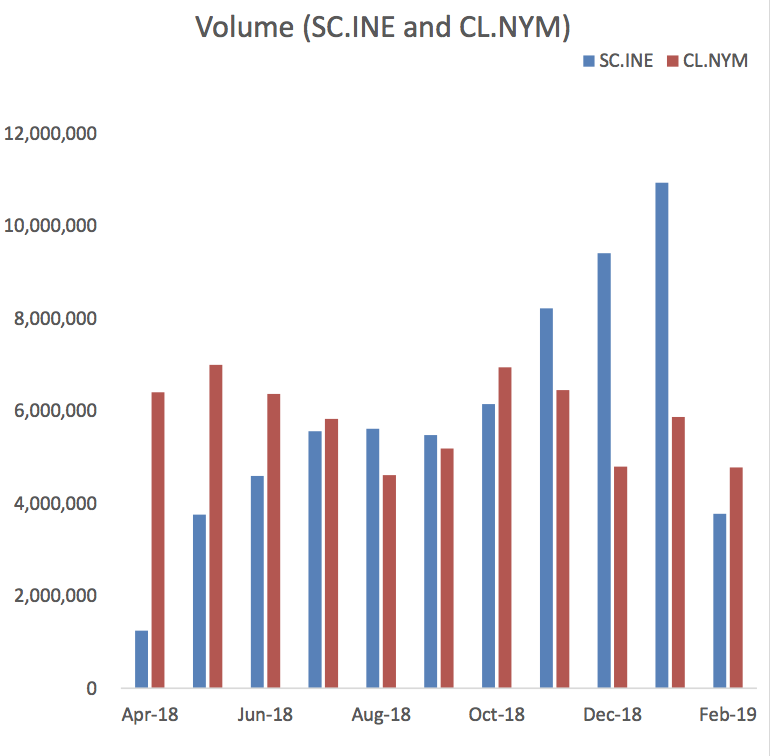

Since 3/26/2018 and up to 3/11/2019 closing, Shanghai crude oil futures’ cumulative trading volumes is 70.29 million lots, and the cumulative trading volumes of the first month of listing (2018/3/26-2018/4/25) is 1.33 million lots. The cumulative amount of transaction is 32.84 trillion yuan (3/26/2018-3/11/2019), which is 57.9 times that of the cumulative amount of the first month of listing.

This week, average daily turnover of the main contract is 308905.6 lots, and last week average daily turnover of the main contract is 273600lots. Open interest of all the contracts of crude oil futures of INE also rised steadily, with 3,558 lots on 3/26/2018 and 61958 lots after the closing of 3/11/2019.

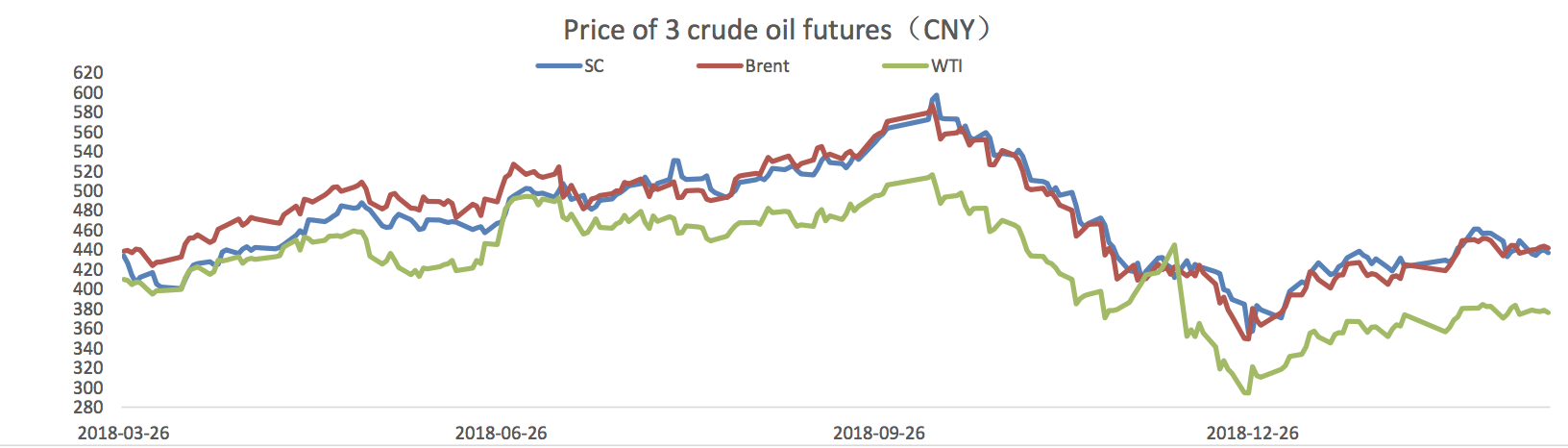

Compared with the intra day high and low volatility of three major crude oil futures, the amplitude of Chinese crude oil futures in most of the time is lower than Brent and WTI, indicating that Chinese crude oil futures did not have excessive fluctuations in the day because of the significant speculative ratio and the short time of the market.

As can be seen from the above graph, since August 2018, the volume of SC.INE has exceeded the volume of B.IPE.

Part C: Correlation analysis

Graph :Price of 3 crude oil futures(in CNY,2018/3/26-2019/3/8)

Table:Correlation of three crude oil futures (2018/3/26-2019/3/8)

|

|

SC | Brent | WTI |

| SC | 1 |

|

|

| Brent | 0.941862 | 1 |

|

| WTI | 0.847857 | 0.937781 |

1 |

It can be seen that the SC-Brent spread was kept in a stable range, with almost no risk-free arbitrage opportunities. The spread of the price difference with WTI was huge and the high and low points were more than 100 CNY/barrel, which may due to that WTI crude oil cannot be used as the delivery of INE. Therefore, the link between SC and WTI price is not as close as that between Brent and Oman.

Table:Correlation between crude oil futures and major chemical futures in China (2018/3/26-2019/3/8)

| Correlation | Brent | WTI | asphalt | Polypropylene | Polyvinyl chloride | Pure Terephthalic Acid | Linear Low Density Polyethylene | Methanol |

| Firsr month of listing | 0.8437 | 0.8444 | 0.2435 | 0.1122 | 0.5681 | 0.9172 | -0.0234 | -0.1445 |

| Listed so far | 0.9472 | 0.8556 | 0.9074 | 0.9220 | 0.4386 | 0.6691 | 0.7202 |

0.9056 |

As can be seen from the above table, the correlation between China's crude oil futures and major domestic chemical products has been greatly improved. On the one hand, the substantial increase in correlation will stimulate the continuous influx of arbitrage funds, which will help to enrich and optimize the strategy; On the other hand, it is also a sign that China's crude oil futures market is maturing, which is conducive to the function of price discovery. It also has great significance for enterprises to use futures tools for hedging.

It can be seen that China's crude oil futures and the RMB exchange rate are obviously negatively correlated.

Part D: Spread analysis

Graph :Price Difference(in CNY, 2018/3/26-2019/3/8)

Copyright by Fangquant.com