Market Summary:

Last week, there was generally increase over the market. SSE Composite Index (000001.SH) changed 1.75 % to 3021.75. Specifically, large cap shares perform slightly better than small cap shares and we can observe that SSE50 did better than CSI500 (2.61% vs 2.16%).

As for the overall market valuations, though there are rising, they remain at low level in a longer historical view.

As for Credit spread between A-rate corporate bonds, a small drop for 1Y spread is observed. As for the spread between Shibor Rates and Treasury bonds yield, short-term spread kept its high position. As for treasury bond yield, last week, there is no obvious change and the shape remain the same as last week.

As for exchange rate, there were some appreciation for both inland and offshore rates, that CNY/USD changed -0.23% (up to 16:30 of last Friday) and CNH/USD changed -0.26%.

As for foreign fund flows via both Shanghai and Shenzhen-Hong Kong Stock Connect, last week there were net inflows for Shanghai but outflows for Shenzhen market. The total net inflow over last week was 1.28 billion CNY and the cumulative net inflow was 768.78 billion CNY at last Friday, another historical new high.

In sum, after last week’s drop, there is a rebound. Currently, the valuation level has been significantly repaired, chance for sudden rise like what happened in February is low. As valuation levels like PE and PB for small cap shares are lower in view history record, they may have better chance in following period.

News:

(1) The CSRC intends to amend the relevant provisions of the Guidelines on the Articles of Association of Listed Companies and publicly solicit opinions from March 15. There are three main aspects in this revision: firstly, there are specific requirements in the articles of association of listed companies with special equity structure; secondly, the statutory situation of acquisition of shares by listed companies should be perfected, and the acquisition methods, decision- making procedures and requirements for dealing with shares should be clarified; thirdly, the meeting of shareholders, the dismissal of directors and directors should be held in the light of the Governance Criteria of Listed Companies and the practice of The establishment of special committees and the requirements of senior managers should be improved.

(2)Securities China: Liu Feng, president and chief economist of Galaxy Securities Research Institute, commented on the bearish report that the evaluation given by the research paper is only to judge whether the current market price has seriously deviated from the "theoretical valuation or value" level of the stock. It does not indicate whether the company is good or bad. A company with good performance may also be overvalued by the market, and a company with poor performance may also be undervalued by the market.

(3)Shanghai Stock Exchange: It is a major event to set up a scientific innovation board and pilot registration system. Membership units should "strictly control seven gates" - clearance of trading authority, selection of enterprises, issuance and pricing, declaration of materials, supervision of transactions at the initial stage of listing, security and integrity of the system; and set up a scientific innovation board and pilot registration system headquarters led by its main leaders, with 11 headquarters on-line. The readiness group covers the main working lines of issuance, auditing, trading, monitoring, system, news, etc.

(4)The Shanghai Stock Exchange will set up a self-discipline Committee for stock issuance of the scientific innovation board, aiming at giving full play to the self-discipline role of the industry, guiding the market to form good and stable expectations, and ensuring the smooth and orderly issuance and underwriting of stock on the curriculum.

1. Indices

(1) Indices Performance

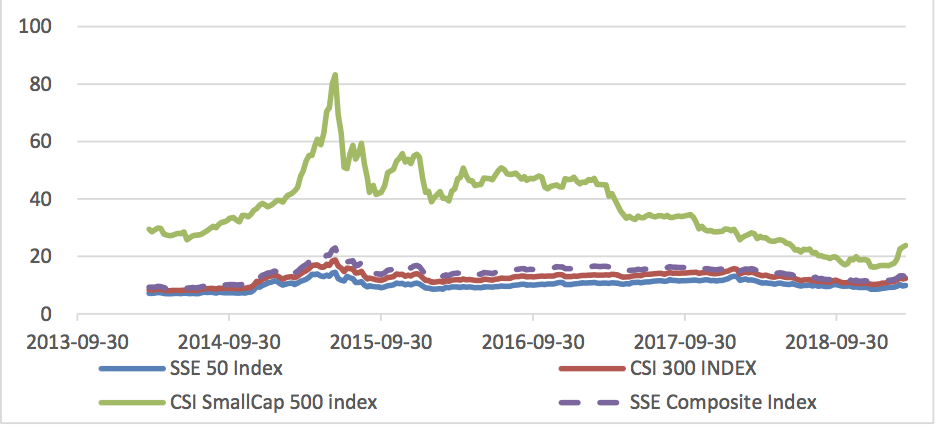

Graph 1: Indices performance over the past 3 months

During last week, SSE Composite Index (000001.SH) changed 1.75 % to 3021.75, CSI 300 INDEX (000300.SH) changed 2.39 % to 3745.01, CSI SmallCap 500 index (000905.SH) changed 2.16 % to 5359.01, SSE 50 Index (000016.SH) changed 2.61 % to 2755.81, FTSE China A50 Index (830009.XI) changed 2.88 % to 12651.86.

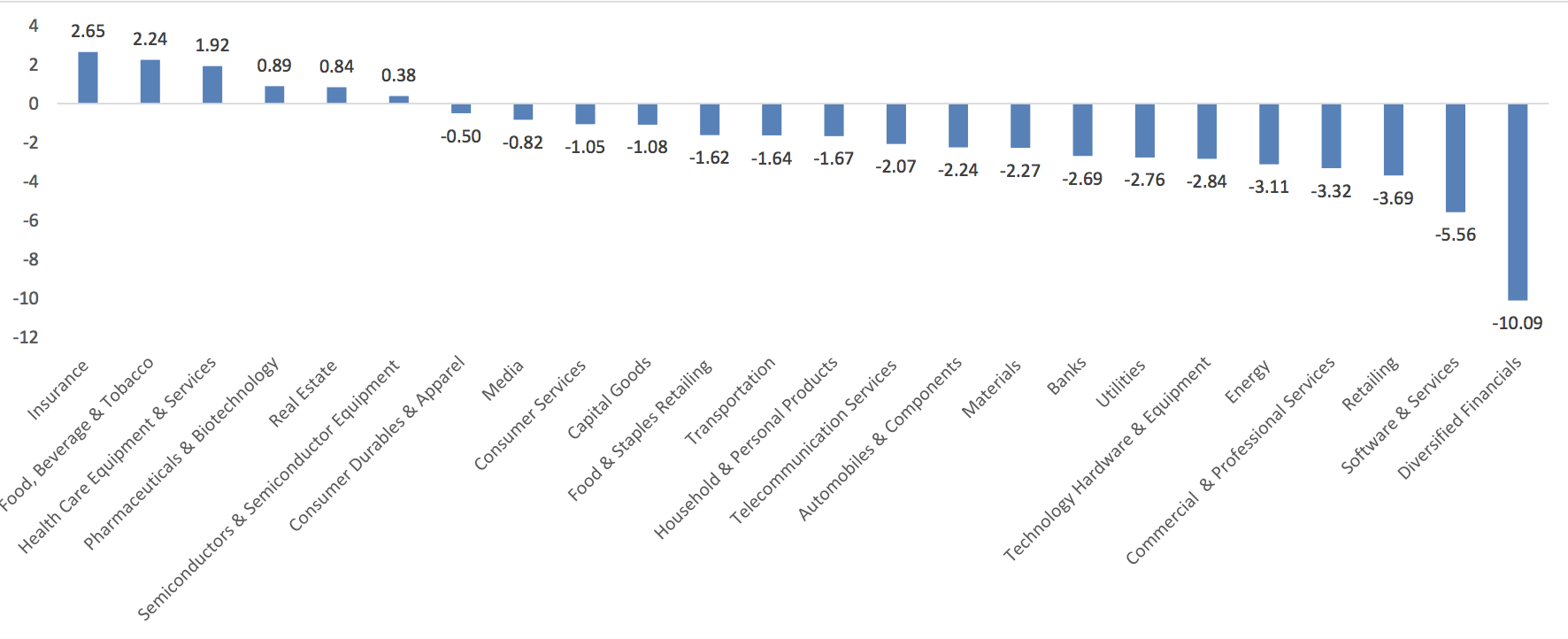

(2) Sectors Performance

Graph 2: Sectors performance under Wind Level-2 classification (%)

In the view of sectors, during last week(from 2019-03-08 to 2019-03-15), 6 of 24 Wind Level-2 sector(s) increased while 18 sector(s) dropped. Specifically, Insurance (2.65%), Food, Beverage & Tobacco(2.24%) and Health Care Equipment & Services(1.92%) did the best performance while Diversified Financials(- 10.09%), Software & Services(-5.56%) and Retailing(-3.69%) did the worst performance.

(3) Indices Valuation Measures (TTM)

Graph 3: Indices P/E Ratio over recent 5 years (TTM)

The current P/E for SSE50, CSI300, CSI500, SSE Composite Index are 9.8541,12.3269,23.8261,13.3176 respectively.

Graph 4: Indices P/B Ratio in recent 5 years (TTM)

The current P/B for SSE50, CSI300, CSI500, SSE Composite Index are 1.2270,1.4888,1.9857,1.4813 respectively.

Graph 5: Indices P/CFO Ratio in recent 5 years (TTM)

The current P/CFO for SSE50, CSI300, CSI500, SSE Composite Index are 6.3657,9.0697,22.7281,9.5626 respectively.

Graph 6: Indices P/S Ratio in recent 5 years (TTM)

The current P/S for SSE50, CSI300, CSI500, SSE Composite Index are 1.1101,1.2454,1.2397,1.1841 respectively.

Graph 7: Indices CFO/E Ratio (=(P/E Ratio)/(P/CFO Ratio)) in recent 5 years (TTM)

The current CFO/E for SSE50, CSI300, CSI500, SSE Composite Index are 1.5480,1.3591,1.0483,1.3927 respectively.

Graph 8: Indices ROE (=(P/B Ratio)/(P/E Ratio)) over the past 5 years (TTM)

The current ROE for SSE50, CSI300, CSI500, SSE Composite Index are 0.1245,0.1208,0.0833,0.1112 respectively.

2. Interest Rates

The term structure of treasury bonds’ yields is currently upward sloping in concave shape. Specifically, last week, short-term yields short term yield of treasury bond experienced some fluctuation and 3M yield now at 2.0%-2.2% level. Furthermore, as for long-term yield, there is a small fluctuation. 10Y yield is about 3.0%-3.2%.

Graph 9: Term Structure Evolvement of Treasury Bonds During Recent 3 Months (%)

3. Credit Risk

Graph 10: Differences Between Shibor Rates and Treasury Yields During The Period Of Recent 3 Month (%)

Graph 11: Differences Between Corporate Bonds Yields (A Rate) and Treasury Yields During The Period Of Recent 3 Month(%)

4. Exchange Rates

Graph 12: USD/CNY, USD/CNH and USD Index in the Period Of Recent 1 Month

5. Foreign Fund Flow

Graph 13: Fund flow via both Shanghai and Shenzhen-Hong Kong Stock Connect in past 1M (100 million CNY)

Graph 14: Fund flow via both Shanghai-Hong Kong Stock Connect in past 1M(100 million CNY)

Graph 15: Fund flow via both Shenzhen-Hong Kong Stock Connect in past 1M(100 million CNY)

6. Index Future Market Liquidity

Graph 16: CSI300 Current/Next Month Contract Roll Spread Distribution (2s frequency)

Graph 17: SSE50 Current/Next Month Contract Roll Spread Distribution (2s frequency)

Graph 18: CSI500 Current/Next Month Contract Roll Spread Distribution (2s frequency)

There are 5 trading days during last week, so the distribution is worked out with 36005 data points for each contract.

Macroeconomic Topic:

The central bank released financial and monetary data on last Sunday. The data showed that the new social finance scale in February was only 703 billion yuan. Although it fell 84.83% from the previous year, the total new social finance scale in January to February was 533.82 billion yuan, which was 25% higher than the 4268.66 billion yuan in the same period last year.

February Finance Data

(1) Social Financing Data

Graph A: Total Social Financing Data(100m RMB)

In on-balance-sheet financing, 764.1 billion yuan of new RMB loans were added that month, and 4330.936 billion yuan of new RMB loans were added in January and February. The ring ratio fell 78.58%. In the same period last year, it was 370.475 billion yuan, an increase of 16.9% over the same period last year.

Graph B: On-balance-sheet Financing Data(100m RMB)

From the perspective of new off-balance sheet financing, due to the dramatic contraction of new acceptance bills, the overall contraction of new off- balance sheet financing was 364.8 billion yuan, of which the new non-discounted bank acceptance bills shrank by 310.3 billion yuan.

Graph C: Off-balance-sheet Financing Data(100m RMB)

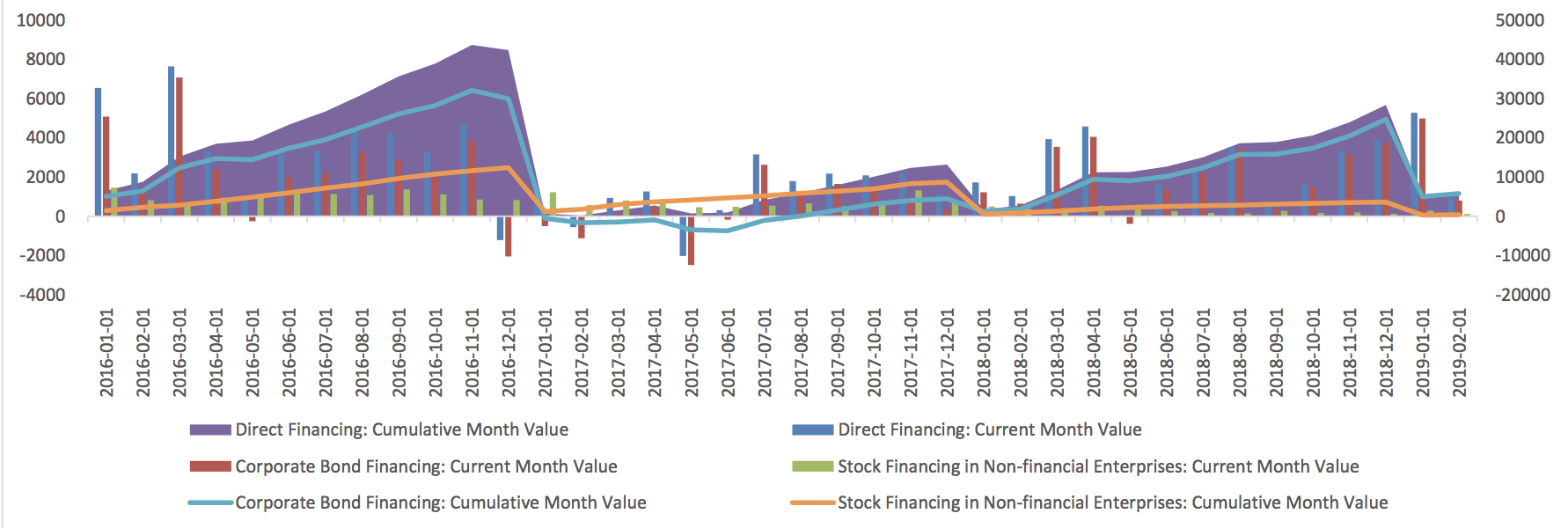

In terms of the direct financing business of new enterprises, the ring ratio also declined in February, which should be affected by the Spring Festival factors to a certain extent. The requirement of normalization of IPO by CSRC and the requirement of the central government to increase the proportion of direct financing and the relative prosperity of the market will promote the development of direct financing of enterprises this year.

Graph D: Direct Financing Data(100m RMB)

(2) Monetary Data

Data show that in February, M0 fell back to - 2.4%, M1 rose from 0.4% to 2%, but M2 dropped from 8.4 to 8%.

Graph E: M1 and M2 data (%)

The negative factors of M2 are as follows: firstly, fiscal deposits increased by 324.2 billion yuan, an increase of 852.9 billion yuan over the same period last year; secondly, household deposits decreased by 1540 billion yuan.

The positive factors of M2 are that drop of deposits of non-financial enterprises decreased by 120 billion yuan; secondly, deposits of non-bank enterprises increased by 362.3 billion yuan.

(3) Summary

In conclusion, despite the impact of the Spring Festival factors, the social and financial ring ratio has fallen sharply, but the cumulative increase from January to February is significant year-on-year, and the structure has also shown a certain improvement trend.

According to the Quarterly Monetary Implementation Report of the Central Bank and the press conference of the Central Bank on Sunday, monetary policy is relatively easy. Direct financing of enterprises, especially equity financing, will be normalized, the proportion of direct financing will be greatly increased, bill financing will be affirmed by the central bank to a certain extent, and it is expected to recover. The scale of local special debt this year will also exceed that of last year. Therefore, the scale of new social finance is expected to grow overall, and the structure will also be improved. The structural support of the real economy, especially small and micro enterprises and private enterprises.

In terms of monetary policy, the central bank still has room to reduce the reserve rate on the premise of insisting on directional drip irrigation instead of flooding irrigation. The central bank will reduce the risk-free interest rate through open market activities and MLF operations, reduce the real interest rate and promote the downward trend of market interest rate.

Copyright by fangquant.com