Market Summary:

Last week, there was generally decrease over the market. SSE Composite Index (000001.SH) changed -4.52 % to 2939.21. Specifically, small cap shares perform slightly better than large cap shares and we can observe that CSI500 did better than SSE50 (-4.58% vs -5.14%). The trading activity shrank as the average daily turnover dropped to 545.8 billion RMB.

Last week, US decided to add tariff from 10% to 25%, though the trade negotiation is continuous. The action greatly impacted the market confidence of prospect. Thus, the market dropped sharply. However, the high level of China showed the altitude that “we hope for negotiation but never afraid of fight, and never give up core interest but seeking fair deal”. This seems that the trade negotiation should be ongoing and might not end in a short period.

Due to trade confliction, foreign fund kept outflow via stock connects for all 4 opening days last week, exchange rate experienced great deprecation of over 1% and valuation also shrank.

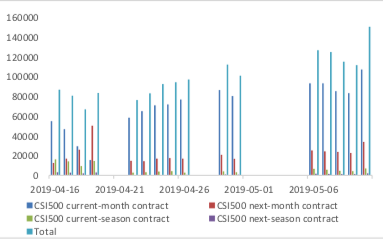

We observed that CSI500 current month future contract kept huge discount during the whole week that it kept showing arbitrage opportunity (by selling spot buying futures) under our calculation assumption. This may due to that there was insufficient spot for short selling so that future-spot arbitrage opportunity cannot be locked. For other contracts arbitrage opportunity also showed up but not kept for very long time.

News:

(1) Guo Shuqing, chairman of the Banking and Insurance Regulatory Commission, recently met with Adam Person, director of the Peterson Institute of International Economics and his delegation. The two sides exchanged views on monetary credit, financial science and technology, and the opening up of the financial industry. With regard to the opening up of the financial industry, Guo Shuqing further indicated that the opening door of China's financial industry will be wider and wider. He welcomed all kinds of foreign financial institutions to come to China and cooperate with Chinese financial institutions on the same platform and in various fields to achieve "win-win" through common competition.

(2) Securities dealer China: In the context of global capital outflow from the stock market, the A-share ETF has emerged with 10 billion-level bottom-chasing funds. Wind data show that the share of major index funds in the A-share market has increased by a certain extent in the past week, with a total share increase of 4.134 billion, with a market value of more than 12.2 billion yuan at weekly average prices. In terms of valuation comparison, China's assets are much cheaper than the U.S. index.

(3) Xinhua News Agency Quick Review: The United States has to deal with bullying calmly. In recent days, "the United States has increased tariffs on $200 billion of Chinese imports from 10% to 25%. Before the eleventh round of high-level economic and trade consultation between China and the United States, it reflected the bullying intention of the United States to exert pressure on the negotiations and increase the bargaining chip for the negotiations at this critical juncture. In fact, over the years, it has become common for the United States to cooperate when it needs to, to tear up agreements when it does not need to, and even to threaten international organizations with "withdrawal" from the ranks and actions. The intentions of the United States to impose extreme pressure are still evident. We might as well look at it coldly.

(4) According to Xinhua News Agency, Liu He, member of the Political Bureau of the CPC Central Committee, Vice Premier of the State Council and Chinese leader of the China-US Comprehensive Economic Dialogue, told the media after the eleventh round of high-level economic and trade consultation that Sino-US relations are very important and that economic and trade relations are the "ballast stone" and "propeller" of Sino-US relations, involving not only bilateral relations, but also world peace and prosperity. Cooperation is the only right choice for both sides, but cooperation is principled and China will never compromise on major principles. Liu He said that the most important thing for China is to do well in its own affairs. China's domestic market demand is huge, and the promotion of supply-side structural reform will lead to the overall improvement of product and enterprise competitiveness. There is still ample room for fiscal and monetary policies. China's economic prospects are very optimistic.

(5) Xinhua News Agency published an article saying that there was no winner in the trade war - all parties opposed the US tariff escalation measures against China. The US side recently raised its tariff on 200 billion US dollars of Chinese imports from 10% to 25%. In view of the unilateralism of the United States, it is generally believed that tariff imposition will not help solve the problem. It will not only harm the economies of the United States and China, but also bring about negative impacts on the world economy.

(6) [People's Daily Bell: China will not yield to any extreme pressure] China has been promoting Sino-US economic and trade negotiations with a highly responsible attitude and utmost sincerity, but will never yield to the extreme pressure of the United States and will not compromise on the issue of principles. In particular, the United States should choose to follow the trend and work with China to solve problems through equal consultation and create a future on the road of win-win cooperation.

(7) China Securities Journal: [After V-type reversal, A shares stabilized?] Experts said that whether from the basic, policy and valuation level, the A-share market still has room for improvement; the gold decade of the A-share market has begun, and the future market will still maintain an upward trend, now is the time to need confidence and patience; in the long run, the first "bull" in the history of A-share may be slowly brewing.

1. StockMarket

(1) Indices Performance

During last week, SSE Composite Index (000001.SH) changed -4.52 % to 2939.21, SHENZHEN COMPONENT INDEX (399001.SZ) changed -4.54 % to 9235.39, ChiNext PRICE INDEX (399006.SZ) changed -5.54 % to 1533.87, CSI 300 INDEX (000300.SH) changed -4.67 % to 3730.45, CSI SmallCap 500 index (000905.SH) changed -4.58 % to 5064.32, SSE 50 Index (000016.SH) changed -5.14 % to 2793.76.

Graph 1: Indices Performance over past 3 months

The average daily turnover of the whole market during past 5 trading days is 545.80 billion CNY, it decreased 13.42% compared with the previous 5-trading day period.

Graph 2: Market turnover

(2) Sectors Performance

In the view of sectors, during last week (from 2019-05-3 to 2019-05-10), 1 of 24 Wind Level-2 sector(s) increased while 23 sector(s) dropped. Specifically, Food & Staples Retailing (0.51%), Semiconductors & Semiconductor Equipment (-0.56%) and Consumer Durables & Apparel(-2.77%) did

the best performance while Telecommunication Services (-6.36%), Insurance (-5.89%) did the worst performance.

Graph 3: Sectors performance under Wind Level-2 classification (%)

(3) Indices Valuation (TTM)

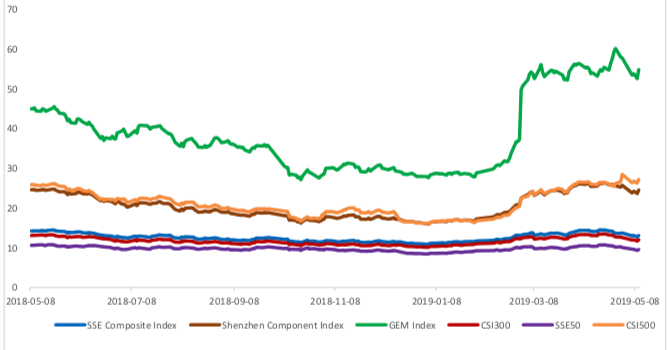

The current PE for SSE Composite Index, Shenzhen Component Index, GEM Index, CSI300, SSE50, CSI500 are 13.0832, 24.5153, 54.8062, 11.9758, 9.5497, 27.1613respectively; and these indices are at 25.70%, 36.60%, 62.90%, 33.40%, 30.30%, 24.60% percent rank level of their historic data, respectively

Graph 4: PE of 6 indices

Graph 5: PE percent rank of 6 indices (calculated by data of past 1200 trading days, only 1Y data is presented on the graph)

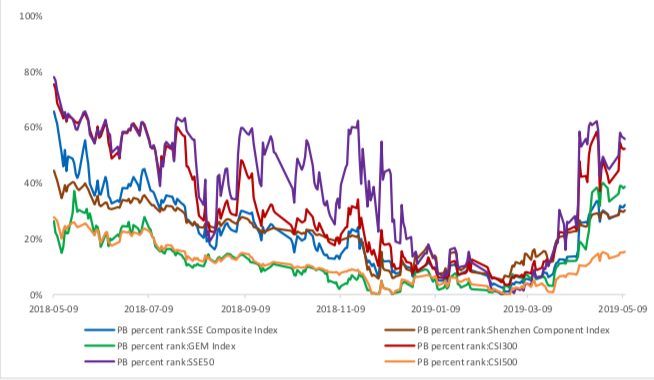

The current PB for SSE Composite Index, Shenzhen Component Index, GEM Index, CSI300, SSE50, CSI500 are 1.5185,2.6827,4.7397,1.5190,1.2443, 2.0682respectively, and these indices are at 32.10%, 30.10%, 38.60%, 52.20%, 55.70%, 15.30% percent rank level of their historic data, respectively.

Graph 6: PB of 6 indices

Graph 7: PB percent rank of 6 indices (calculated by data of past 1200 trading days, only 1Y data is presented on the graph)

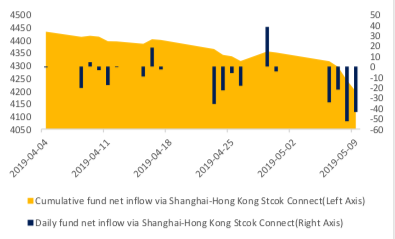

(4) Foreign Fund Flow

Last week, there were 2 trading days for northward channel open for stock connect programs. During last week the total foreign fund flow via Stock Connect is -17.96 billion RMB, and the cumulative inflows was 731.76 billion RMB. Specifically, the fund flow via Shanghai-Hong Kong Stock Connect is -15.71 billion RMB and the fund flow via Shenzhen-Hong Kong Stock Connect is -2.25 billion RMB.

Graph 8: Fund flow via both Shanghai and Shenzhen-Hong Kong Stock Connect in past 1M (100 million CNY)

Graph 9: Fund flow via Shenzhen-Hong Kong Stock Connect in past 1M (100 million CNY)

Graph 10: Fund flow via both Shanghai-Hong Kong Stock Connect in past 1M (100 million CNY)

2. Index Futures

(1) Trading Volume and Open Interests

During past 5 trading days the average trading volume for CSI300(IF), SSE50(IH), CSI500(IC) contracts

are 158297 (22.36%, the previous 5-trading day period),70517 (20.55%),125595 (26.49%) lots, respectively. On the last trading day, the total open interests for them are 143566 (17.80%),70183 (14.98%),127105 (15.54%) lots respectively.

Graph 11: CSI300 Index futures’ trading volume

Graph 12: CSI300 Index futures’ open interests

Graph 13:SSE50 Index futures’ trading volume

Graph 14: SSE50 Index futures’ open interests

Graph 15: CSI500 Index futures’ trading volume

Graph 16: CSI500 Index futures’ open interests

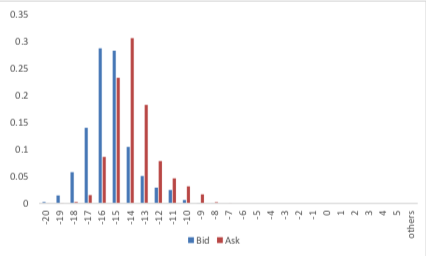

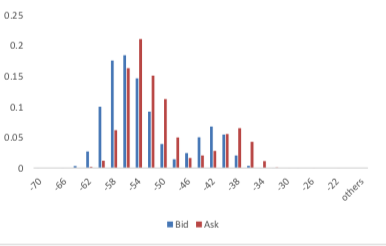

(2) Roll Level Bid-Ask Distribution

There are 5 trading days during last week, so the distribution is worked out with 36005 data points for each contract pair.

Graph 17: CSI300 Current/Next Month Contract Roll Spread Distribution (2s frequency)

Graph 18: SSE50 Current/Next Month Contract Roll Spread Distribution (2s frequency)

Graph 19: CSI500 Current/Next Month Contract Roll Spread Distribution (2s frequency)

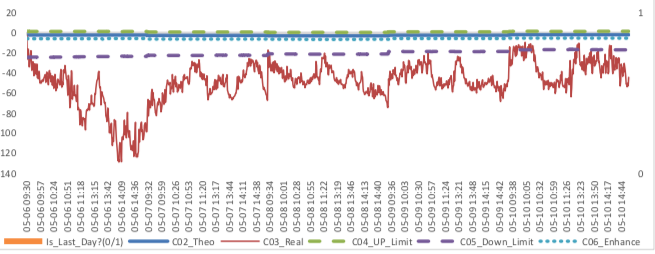

Assumption: risk-free rate: 3%; security borrowing cost: 8%; trading expense for spot: 0.025%; trading expense for futures: 0.005%; margin rates for futures contracts: 0.11 for CSI300 and SSE50, 0.13 for CSI500; margin rate for security borrowing: 0.3 (or 130% maintain rate).

When real price spread is out of theoretical range (calculated by our assumption), there exists absolute future-spot arbitrage opportunity.

Graph 20: Future (Current Month)-Spot Arbitrage Opportunity for CSI300 contract (in the view of price difference)

Graph 21: Future (Current Month)-Spot Arbitrage Opportunity for SSE50 contract (in the view of price difference)

Graph 22: Future (Current Month)-Spot Arbitrage Opportunity for CSI500 contract (in the view of price difference)

3. Financial Markets

(1) Interest Rates

The term structure of treasury bonds’ yields is currently upward sloping in concave shape.

Specifically, last week, short-term yields short term yield of Treasury bond experienced some fluctuation and 3M yield now at 2.2%-2.4% level. Furthermore, as for long-term yield, there is a small downward move. 10Y yield is about 3.2%-3.4%.

Graph 23: Term Structure Evolvement of Treasury Bonds Yields During Recent 3 Months (%)

As for Shibor rates, short-term rates experienced significant fluctuation. Specifically, O/N rate experienced obvious fluctuation to 1.6%-1.8% level.

Graph 24: Term Structure Evolvement of Shibor Rates During Recent 3 Months (%)

(2) ExchangeRates

During last week, CNY/USD changed 1.12% to 6.8118 and offshore rate, CNH/USD, changed 1.59% to 6.8450 and USD index changed -0.19%.

Graph 25: USD/CNY, USD/CNH and USD Index

Macroeconomic Topic:

The central bank released financial and monetary data on Thursday and most of which below market expectations. Particularly, both medium-term and long-term loans and short-term loans of RMB have declined considerably, which has attracted attention. The off-balance sheet businesses continued to decline except for trust loans. The ring ratio of local debt financing also declined. The data showed, in April, 1360 billion yuan of new social financing was added, much lower than 2852.56 billion yuan in March and 1776.95 billion yuan in the same period last year.

April Finance Data

(1) Social Financing Data

Graph A: Total Social Financing Data(100m RMB)

In on-balance-sheet financing, new RMB loans increased by only 873.3 billion yuan, much lower than 1959.1 billion yuan in March and 1100 billion yuan in the same period last year. Foreign currency loans decreased by 33 billion yuan. In April, the RMB exchange rate was relatively stable, but foreign currency loans still showed a net decrease.

Graph B: On-balance-sheet Financing Data(100m RMB)

From the perspective of new off-balance sheet financing, the net decrease of new off-balance-sheet business was 142.7 billion yuan, and 82.394 billion yuan was added last month. Among them, only new entrusted loans increased by 12.9 billion yuan, new entrusted loans and new undiscovered bank notes decreased by 119.9 billion yuan and 357 billion yuan respectively. The growth rate of bill business in the new statement is much lower than that of bill financing in the new statement, which means that liquidity preference increases.

Graph C: Off-balance-sheet Financing Data(100m RMB)

In terms of the direct financing, compared with March, there was a little recovery growth in April, including 357.4 billion yuan in new debt financing, 327.598 billion yuan in March, 26.2 billion yuan in new equity financing, a significant increase compared with March, which was only 11.6 billion yuan in March.

Graph D: Direct Financing Data(100m RMB)

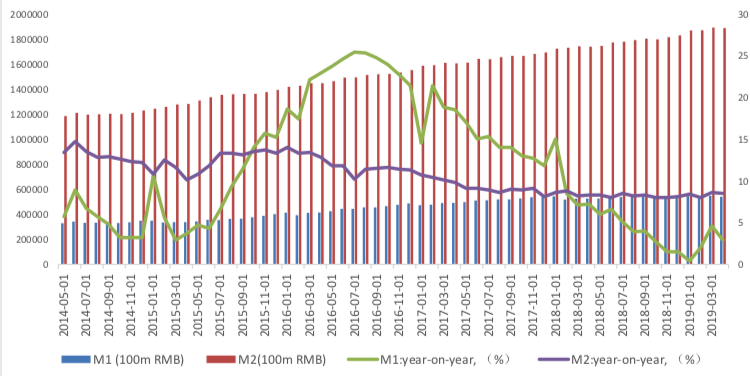

(2) Monetary Data

Data show that in April, both M1 and M2 fell back, reporting 2.9% and 8.5% respectively, and the preceding values were 4.6% and 8.6% respectively, which led to the increase of the scissors difference between M1 and M2 from - 4% to - 5.6%.

Graph E: M1 and M2 data

The negative factors of M2 are as follows: deposit of non- financial institution has a more decrease of 719.4 billion yuan. Household deposits decreased by 691.6 billion yuan, deposits of non-financial enterprises increased by 83.3 billion yuan

The positive factors of M2 are as follows: fiscal deposits has an decrease rise of 183.7 billion yuan.

(3) Summary

From a positive perspective, the recovery of direct financing has risen, especially the ring ratio of equity financing has risen sharply. However, the sharp drop of equity market in May will affect the scale and progress of direct financing in May. The sharp rise in bill financing is related to the relative stability of bill discount rate at a low level, which also reflects the strong demand for short-term financing.

Copyright by fangquant.com