On November 8th, Chang depeng, a spokesman for the CSRC, said that the pilot work of expanding stock index options was officially launched, and the CSI 300 ETF options listed on the Shanghai Stock Exchange and Shenzhen Stock Exchange, and the CSI 300 index options listed on the China financial Futures exchange were approved in accordance with the procedures.

One day later, CFFEX informed the public about the CSI 300 stock index option contracts and relevant rules.

It should be noted that the launch of stock index option is the first financial futures option product in China. With the launch of this product in the future, financial options are expected to expand to SSE50, CSI500, and even treasury bond futures.

Market capacity and coverage increase greatly

The CSI 300 ETF options to be listed on the Shanghai and Shenzhen stock exchanges are based on the stable operation of the Shanghai Stock Exchange 50 ETF options for more than four years.

According to statistics, since the listing of SSE 50ETF options, the annual average daily turnover has increased from 0.1 million to more than 2 million, the total position has increased from less than 0.3 million to more than 4 million, the actual average daily turnover has increased from 100 million to 1.4 billion, the corresponding nominal principal has reached the level of 60 billion, and the market capacity has improved significantly, which is also reflects the huge demand of market investors for option instruments.

On the other hand, this year's capital market has accelerated its opening-up, with MSCI and other three major international indexes converging on a shares.

In January, the SAFE increased the total quota of QFII from $150 billion to $300 billion; in September of the same year, the SAFE again announced that it would cancel the quota limit of QFII and RQFII investment. At the same time, the restrictions of RQFII pilot countries and regions were also removed.

In addition, taking MSCI index as an example, on May 31, 2018, a share was included in MSCI index for the first time with a factor of 2.5%, and in August of the same year, the factor of a share was increased to 5%. This year, MSCI announced that it will increase the A-share inclusion factor from 5% to 20% in May, August and November.

FTSE Russell and S & P Dow Jones have not been included.

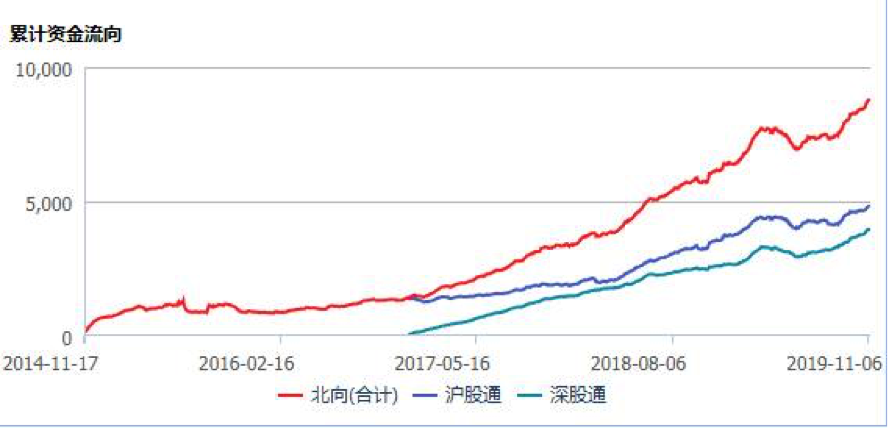

Changes at the data level are also evident. Although the inflow of northward funds fell after reaching a stage high in March this year, its shareholding scale has continued to rise since late September, reaching 881 billion yuan on November 8, an increase of 37% over the end of last year.

With the acceleration of the pace of opening up and the continuous inflow of foreign capital, the domestic risk hedging tools are slightly insufficient, with only the SSE50ETF option and the stock index futures that are not fully "normalized".

It is inevitable to expand the capacity of existing hedging instruments so as to increase the market capacity.

securities research report pointed out that the expansion of options significantly increased market coverage. Shanghai Stock Exchange and Shenzhen stock exchange each add CSI 300ETF options. The options underlying are Huatai-Pinebridge CSI 300ETF (510300.OF) and Harvest CSI 300ETF, respectively. As of 2019 Q3, the total scale of the subject matter is 34.51 billion yuan and 22.65 billion yuan respectively.

In addition, CFFEX plans to carry out the listing of CSI 300 stock index options in the near future. The CSI 300 index (3903.689, 0.71, 0.02%) is the core broad-based index of China's A-share market. The value of the index component stock market is about 30 trillion yuan, accounting for about 60% of the total A-share market value. The asset size of the tracking CSI 300 index is more than 150 billion yuan.

Leading securities companies and futures companies benefit first

On November 8th, on the day when regulators announced the expansion of options, Ruida Futures (31.930, - 0.71, - 2.18%) rose by 7.11%, and Nanhua Futures (21.800, - 1.21, - 5.26%) rose by 7.11%

The reason lies in the potential increase of business income of the two companies caused by the expansion of stock index options.In fact, from the perspective of innovative business, the top securities companies can take the lead in obtaining the pilot qualification.

As the first financial option product of CFFEX, the CSI 300 stock index options will follow this rule. After the launch of the 50ETF option in Shanghai Stock Exchange, some of the top futures companies have tested first.

According to the Research Report (5.760, 0.06, 1.05%), by the end of August this year, the total number of 50ETF option investor accounts was 387700, an increase of 26% compared with 307800 at the end of 2018.

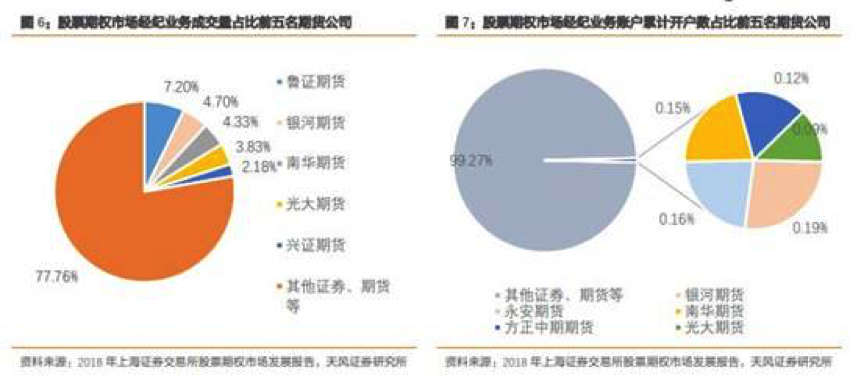

Among them, the brokerage business volume of futures companies is 118.3136 million (two-way), accounting for 18.71% of the total market volume. Futures companies opened 3978 options brokerage accounts, accounting for 1.31% of the total number of accounts opened in the market.

Although the number of investors from the port of futures company is not large, the proportion of trading volume is very considerable.

From the perspective of transaction purpose, insurance, enhanced income, arbitrage and directional transaction accounted for 13.97%, 45.29%, 22.35% and 18.39% respectively. From the perspective of investor categories, institutional investors mainly focus on enhancing earnings and arbitrage trading, while individual investors mainly focus on enhancing earnings and directional trading.

It can also be seen from the figure above that the number of stock options accounts and the proportion of trading volume are currently the top futures companies, such as Galaxy futures, Yong'an futures and Nanhua futures, while the listed Ruida futures are not on the list.

The above rules apply to securities companies as well.

At present, 85 securities companies and 25 futures companies have carried out the trading authority of stock option brokerage business, 60 securities companies have opened the trading authority of stock option proprietary business, 10 securities companies are the main market makers of 50ETF options, and 4 securities companies are the general market makers of 50ETF options.

However, it is difficult to determine whether the option business can significantly improve the income of securities companies. After all, compared with futures companies, the income and profit scale of securities companies are higher, and the actual pulling effect is not as obvious as futures companies.

Speed up of "infrastructure" in derivatives market

Although the expansion of CSI 300 ETF options and CSI 300 stock index options is completely predictable, the strength of simultaneous expansion of the three exchanges announced by the regulators one day still exceeds the industry's expectation.

The embodiment construction of domestic financial derivatives market may be entering the stage of acceleration.

According to the American futures association, in the first half of 2019, more than 80 exchanges in the world traded 16.6 billion futures options, up + 11% year-on-year, including 7.3 billion options, up + 13% year-on-year. From the perspective of American market, the main varieties of options market are individual stock options, accounting for 50%, followed by stock index options, accounting for 30%, and ETF options accounting for about 5%.

The 21st century economic reporter thinks that the signal significance of this option expansion can not be ignored, at least two directions can be made clear at present.

First, the most recent time interval for the deregulation of stock index futures has been shortened to 4 months, previously ranging from 7 to 15 months. In the context of accelerated inflow of domestic and foreign capital, it is not ruled out that the deregulation may be restarted before the end of the year. The focus of the deregulation will be on the recovery of market liquidity, because there is no more room for the margin standard to be lowered.

Secondly, after the listing of CSI 300 ETF options and CSI 300 index options, SSE 50 index options, CSI 500 index options and CSI 500 ETF options will become the next batch of new options.

Judging from the rhythm of commodity futures, it may take about a year for CSI 300 stock index options to run smoothly. However, if the speed of foreign capital entering the market does not decrease, the listing time of these varieties will also be listed in advance.

Further more, the introduction of CSI 300 stock index options will open the door to domestic financial futures options, and will expand to Treasury bond futures options in the future, sooner or later

沪深300期权大扩容 A股市场开启多空博弈新平衡

11月8日,证监会新闻发言人常德鹏表示,正式启动扩大股票股指期权试点工作,按程序批准上交所、深交所上市沪深300ETF期权,中金所上市沪深300股指期权。

一天后,中金所关于沪深300股指期权合约及相关规则向社会征求意见的通知。

需要指出的是,此次股指期权的推出,是国内首个金融期货期权产品,未来随着该产品的推出,金融期权有望进步扩容至上证50、中证500,甚至是国债期货。

市场容量、覆盖度大增

拟在沪深交易所上市的沪深300ETF期权,是在建立在上证50ETF期权稳定运行4年多时间基础上的。

据证券公司统计,上证50ETF期权上市以来,年度日均总成交量从10万张水平上升到超过200万张,总持仓量从不足30万张上升到超过400万张,实际日均成交金额从1亿元上升到14亿元,成交对应的名义本金达到了600亿元的水平,市场容量有明显提升,也反映出市场投资者对期权工具的需求巨大。

反观今年的资本市场,开放步伐明显加快,MSCI等国际三大主流指数齐聚A股。

2019年1月,外汇管理局将QFII总额度由1500亿美元增加至3000亿美元;同年9月,外汇管理局再次宣布,取消QFII和RQFII投资额度限制。同时,RQFII试点国家和地区限制也一并取消。

另以MSCI指数为例,2018年5月31日,A股首次以2.5%的因子纳入MSCI指数,同年8月A股纳入因子提高到5%。今年MSCI又宣布将在5月、8月、11月分三步将A股纳入因子从5%提高到20%。

这其中还未将富时罗素、标普道琼斯算在内。

数据层面的变动同样明显。虽然北向资金流入在今年3月触及阶段性高点后回落,但是9月下旬以来其持股规模续刷新高,11月8日时持股资金已达到8810亿元,较去年底增长了37%。

对外开放步伐的加速,以及外资的持续流入,国内风险对冲工具却稍显不足,仅有上证50ETF期权和尚未完全“常态化”的股指期货。

对现有对冲工具扩容,以此提升市场容量变成为了必然选择。

证券公司研报指出,期权扩容标的大幅提高市场覆盖率。上交所和深交所各新增沪深300ETF期权,期权标的分别为华泰柏瑞沪深300ETF和嘉实沪深300ETF。截至2019Q3,标的总规模分别为345.1亿元和226.5亿元。

此外,中金所拟于近期开展沪深300股指期权上市交易,沪深300指数是中国A股市场的核心宽基指数,指数成分股市值约30万亿元,占全部A股市值约60%,跟踪沪深300指数的资产规模超过1500亿元。

头部券商、期货公司率先受益

11月8日,监管层宣布期权扩容消息的当天,多家期货公司股票大涨……

究其原因,在于股指期权扩容对两家公司业务收入的潜在增量。实际上,从创新业务上看,能够率先获得试点资格的均为头部券商。

此次沪深300股指期权作为中金所的首个金融期权产品,大概率也会秉承这一规律。在上证5OETF期权推出后,已经有部分头部期货公司先行试水。

据证券公司研报,截至今年8月底,50ETF期权投资者账户总数为38.77万户,较2018年末的30.78万户增长了26%。

其中,期货公司经纪业务成交量为11831.36万张(双向),占全市场成交量的18.71%。期货公司共开立期权经纪业务账户3978户,占全市场总开户数的1.31%。

虽然来自期货公司端口的投资者人数虽然不多,但是成交量占比却极为可观。

从交易目的上看,保险、增强收益、套利和方向性交易四类交易行为占比分别为13.97%、45.29%、22.35%、18.39%。从投资者类别上看,机构投资者主要以增强收益和套利交易为主,个人投资者则主要以增强收益和方向性交易为主。

通过上图也可看出,股票期权开户数、成交量占比的均为当前排名靠前的期货公司。

上述规律放在证券公司,同样适用。

目前,已有85家证券公司、25家期货公司开展股票期权经纪业务交易权限,60家证券公司开通股票期权自营业务交易权限,10家证券公司为50ETF期权主做市商,4家证券公司为50ETF期权一般做市商。

只是,期权业务能否对各家券商收入带来明显提升尚难确定。毕竟与期货公司相比,券商的收入、利润规模更高,实际拉动效果不如期货公司那般明显。

衍生品市场“基建”提速

虽然沪深300ETF期权和沪深300股指期权的扩容,是完全可以预见的,但是监管层单日宣布三家交易所同时扩容的力度,仍然超出了业内预期。

国内金融衍生品市场的体现建设,可能正在进入提速阶段。

美国期货从业协会披露,2019年上半年全球80多家交易所期货期权成交达166亿手,同比+11%,其中,期权成交达73亿手,同比+13%。从美国市场情况看,期权市场的主要品种是个股期权,占比在50%,其次是股指期权,占比30%,ETF期权占比在5%左右。

“未来我国的期权市场在基础品种创新上还有很大空间,尤其是个股期权尚未破冰。”证券公司非银团队评价称。

对此21世纪经济报道记者认为,此次期权扩容的信号意义同样不容忽视,目前至少可以明确两个方向。

其一,最近一次的股指期货松绑时间间隔已经缩短至4个月,此前在7到15个月不等,在年内外资加速流入的背景下,不排除年底前重启松绑的可能,松绑重点将集中在市场流动性的恢复上给,因为保证金标准已无更多下调空间。

其二,在沪深300ETF期权、沪深300股指期权上市后,上证50股指期权、中证500股指期权和中证500ETF期权将成为下一批次的期权新品。

从商品期货的节奏上看,可能需要沪深300股指期权平稳运行一年左右的时间,但是如果外资进场速度不减,这几个品种的上市时间也会提前上市。

再远一点说,沪深300股指期权的推出,将打开国内金融期货期权的口子,未来还会扩围到国债期货期权,这都是早晚的事……