1.1 The Necessity of Commercial Banks Participating in Treasury Bond Futures Trading

* Commercial banks occupy the most important position among interest rate bonds investors

As of January 2020

* Commercial banks hold 65% of book-entry treasury bonds

* Commercial banks hold 72% of other interest rate bonds

* As the most important investors in the spot market, commercial banks need to participate in futures trading

"Millions of funds in the futures market affect tens of trillions of assets in the spot market"

1.2 Debt investment plays an important role in the assets of commercial banks

* The proportion of debt investment in assets of commercial banks is relatively high

* Take a large joint-stock bank's 2018 annual report as an example

1. Loan assets accounted for 55.5%

2. Debt assets account for about 30%

3. Interest rate bonds accounts for 48% of debt assets, or even higher due to trust and fund assets

1.3 Commercial banks still lack interest rate risk management tools

* Interest rate swap

1. Market liquidity is strong, and the trading notional principal of the five-year Repo was more than 200 billion yuan in December, and that of the one-year Repo was about 500 billion yuan.

2. All types of institutional investors can participate, including policy banks, commercial banks, foreign banks, and securities companies

3. The main active targets are Repo, Shibor, LPR, and the effectiveness of hedging bond assets is not stable enough (rhythm, margin)

* Bond lending

1. The number of participating institutions has increased since the listing of treasury bond futures, with a turnover of about 580 billion yuan in December

2. Short the bond directly to hedge the risk of the bond asset

3. The transaction renewal is troublesome, the short-selling capacity of the single bond is small, and there is a large risk of short-sale replenishment

* Standard Bond Forward

1. The design is inclined to floor trading products, and the target is the policy financial bond

2. As a new product, investors are limited and simple in structure, and the total trading notional principal was 26 billion yuan in December

* Interest rate option

1.4 Treasury bond futures has several advantages as an interest rate risk management tool

* The effectiveness of hedging the risk of interest rate bonds is higher

1. The effectiveness of hedging government bonds with corresponding maturities is extremely effective

2. The effectiveness of hedging local and government bonds is effective

* Liquidity advantage

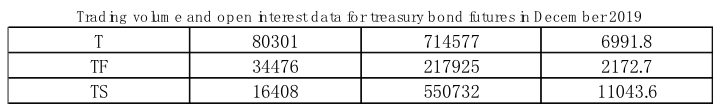

1. The trading notional principal of various varieties in December was about 2 trillion yuan

2. The trading notional principal in mid-to-long term was 900 billion yuan

* Excellent price discovery function

1. Treasury bond futures are the vane of the interest rate market

2. Timely reflection of interest rate market expectations

1.5 Summary

* Commercial banks participate in the futures market as the main investors of interest rate bonds, which is beneficial to the development of the futures market

* There are a large number of interest rate products in the assets and liabilities of commercial banks, and there is a strong demand for interest rate risk management

* The interest rate risk management products that commercial banks can participate in are relatively limited and the hedging effectiveness is not strong

* Treasury bond futures has several advantages as an interest rate risk management tool and is suitable for the demand of commercial banks