Note: from one law office

On 7 May 2020, the People’s Bank of China (“PBOC”) and the State Administration of Foreign Exchange (“SAFE”) issued the Provisions on the Administration of Funds of Foreign Institutional Investors for Domestic Securities and Futures Investment (Announcement by PBOC and SAFE [2020] No.2) (the “New Provisions”). On the same day, PBOC and SAFE issued the Policy Q&A No. 1 of the Provisions on the Administration of Funds of Foreign Institutional Investors for Domestic Securities and Futures Investment (the “Policy Q&A No. 1”), which clarifies the specific operation details involved in the New Provisions. The New Provisions will officially come into effect on 6 June 2020, and the Provisions on the Foreign Exchange Administration of Domestic Securities Investment by Qualified Foreign Institutional Investors (Announcement by SAFE [2018] No.1), the Notice of the People’s Bank of China and the State Administration of Foreign Exchange on Relevant Issues regarding the Administration of Domestic Securities Investment by RMB Qualified Foreign Institutional Investors (Yin Fa [2018] No. 157), and the Notice of the State Administration of Foreign Exchange on the Adjustments to the Data Reporting Method for Qualified Institutional Investors (Hui Fa [2015] No. 45) (collectively, the “Old Provisions”) will be abolished at the same time.

The “foreign institutional investors” mentioned in the New Provisions refer to the Qualified Foreign Institutional Investors (the “QFII”) and RMB Qualified Foreign Institutional Investors (the “RQFII”) (collectively, the “FII”) who have obtained the approval by the China Securities Regulatory Commission (“CSRC”) to invest in domestic securities and futures market. The New Provisions clarify and simplify the administrative requirements of funds of FII for domestic securities and futures investment, so as to further facilitate the FIIs’ participation into China’s financial market. The following is our summary and comments of the highlights of the New Provisions.

I. Administration on Registration with SAFE

Pursuant to the New Provisions, SAFE conducts registration administration on FII’s cross-border funds remittance and foreign exchange.

1. Cancellation of the limits on investment quota

The investment quota administration system originates from the Interim Provisions on Foreign Exchange Administration of Domestic Securities Investment by Qualified Foreign Institutional Investors issued by SAFE at the end of year 2002 and have gone through several optimizing reforms thereafter. For example, in the reform on the administration of QFII and RQFII quota implemented in 2016, the base quota record-filing mechanism replaced the earlier prior-approval mechanism. Under the base quota record-filing mechanism, the base quota of a FII is calculated as a certain percentage of its assets or securities assets under management, and a FII may obtain investment quota within their base quota by making a prior filing with SAFE. Prior approval of SAFE is required for the application for additional investment quota in excess of the base quota.

On 10 September 2019, SAFE announced that upon approval of the State Council, it is decided to generally cancel the limits on investment quotas for QFIIs and RQFIIs and the pilot countries and regions limitation under RQFII regime. Accordingly, PBOC and SAFE issued the Provisions on the Administration of Funds of Qualified Foreign Investors for Domestic Securities Investment (Consultation Paper) on 13 December 2019 (the “Consultation Paper”). After the New Provisions take effect, the domestic securities and futures investment by a FII will no longer be subject to the quota limit.

2. FII may open special cash accounts and conduct fund remittance and foreign exchange after completing registration with SAFE

After obtaining the Securities and Futures Business License granted by CSRC, a FII shall appoint the main reporter to handle the business registration with SAFE. For the inbound remittance of RMB funds to carry out domestic securities and futures investment by the FIIs who has obtained only QFII qualification or the inbound remittance of funds in foreign currencies to carry out domestic securities and futures investment by the FIIs who has obtained only RQFII qualification before the New Provisions take effect, there is no need to submit another application for a new product or business code, and the custodian may continue to use the prior product or business code of such FIIs to open corresponding accounts, handle funds remittance, and report on international receipts and payments for such FIIs according to the requirements of the New Provisions. For the FIIs who have obtained both QFII and RQFII qualifications before the New Provisions take effect, the use of their product or business code will remain the same.

3. Registration materials and registration certificates

According to Article 6 of the New Provisions, to register with SAFE, a FII is only required to submit: (1) the Registration Form for Foreign Institutional Investor (Attachment One of the New Provisions); and (2) a photocopy of Securities and Futures Business License granted by CSRC. Compared with the registration form under the Old Provisions, the information that needs to be filled in the Registration Form for Foreign Institutional Investor in the New Provisions has been greatly simplified. SAFE will issue registration certificate to the FII after the completion of the registration and notify the main reporter.

4. Cancellation of the limit on the number of custodians and implementation of the main reporter system

According to the Old Provisions, a QFII can appoint one PRC custodian only, and an RQFII may appoint at most three PRC custodians. The New Provisions cancel the limit on the number of custodians. According to Articles 3 and 21 of the New Provisions:

-

Any FII appointing two or more PRC custodians shall designate one of them as main reporter (where only one PRC custodian is appointed, such PRC custodian will be deemed as main reporter by default).

-

In case of change of main reporter, the FII shall appoint the new main reporter to handle the registration of change with SAFE within ten working days from the date of change.

Policy Q&A No. 1 clarifies how the main reporter policy would be implemented for existing and new FIIs with the promulgation of the New Provisions. For the FIIs who have obtained only QFII or RQFII qualification before the New Provisions take effect, their prior QFII custodian or RQFII main reporter would be deemed as the main reporter by default, and there is no need to submit a new application for registration. In case of any adjustment, the FII shall appoint the new main reporter to handle the registration of change with SAFE within ten working days after the adjustment. For the FIIs who have obtained both QFII and RQFII qualifications before the New Provisions take effect, such FIIs shall designate one custodian as main reporter within thirty working days after the New Provisions take effect and appoint such main reporter to handle registration of change with SAFE within ten working days from the designation.

It is worth noting that the New Provisions make the FIIs’ obligations to inform more explicit by clarifying that as to the matters such as reporting to and handling registration for the FII with PBOC and SAFE by the custodian, the FII shall appoint the custodian to report to or apply to PBOC and SAFE. In addition, the New Provisions also make it explicit that the FIIs shall cooperate with the custodian in performing the obligation to verify the authenticity and compliance of the receipts and payments of funds and the anti-money laundering and anti-terrorism financing obligations of the custodian.

II. Administration on Accounts

1. FII may freely select the currency of inbound remittance

Pursuant to Article 7 of the New Provisions, a FII, with the registration certificate issued by SAFE, shall open one or more special accounts with the PRC custodian(s) based on its needs of investment and funds remittance. Specifically:

- If a FII remits in foreign currencies only, it is required to open foreign exchange account(s) and RMB special deposit account(s) with each corresponding to the foreign exchange account(s).

- If a FII remits in RMB only, it is only required to open RMB special deposit account(s).

- If a FII needs to remit in both RMB and foreign currencies, it is required to separately open RMB special deposit account(s) for the remitted funds in RMB, and foreign exchange account(s) for the remitted funds in foreign currencies and RMB special deposit account(s) with each corresponding to the relevant foreign exchange account(s); there must be effective distinction in the name of the aforementioned two RMB special deposit accounts, and it is prohibited to transfer funds between these two types of RMB special deposit accounts.

- For an existing QFII, if it needs to remit in RMB, it shall separately open RMB special deposit account(s) for the remitted funds in RMB.

-

For an existing RQFII, if it needs to remit in foreign currencies, it shall separately open foreign exchange account(s) and RMB special deposit account(s) with each corresponding to the relevant foreign exchange account(s) for the remitted funds in foreign currencies.

The currency of funds that a FII remits in and out of China for domestic securities and futures investment shall remain consistent in principle. Cross-currency arbitrage between RMB and any foreign currency is prohibited.

2. FII may open RMB basic deposit account based on its needs

Under the Old Provisions, all FIIs shall open the RMB basic deposit account in the name of the FII before opening the RMB special deposit account(s). According to the New Provisions:

-

Where a FII needs to open only one RMB bank settlement account in the PRC, it may directly open the RMB special deposit account.

-

Where a FII needs to open several RMB bank settlement accounts for its proprietary money, client money, and open-end fund products, it shall open both RMB basic deposit account and RMB special deposit account.

III. Administration on Funds Remittance and Foreign Exchange

1. FII may freely choose the timing of inbound remittance

Where a FII remits in foreign currencies for investment, the FII may, according to its investment plan, timely instruct the custodian to directly settle the funds in foreign currency required for investment and transfer such funds into the RMB special deposit account corresponding to the foreign exchange account. Where a FII remits in RMB for investment, the FII may, according to its investment plan, directly transfer the offshore RMB funds required for investment into its RMB special deposit account.

2. Remittance of investment principal and profits out of China by FII

The Old Provisions impose different remittance and foreign exchange administration on proprietary money, client money and open-end fund products, under which for proprietary money and client money, the investment principal and profits shall be separately remitted outbound, while for an open-end fund product, inbound and outbound remittance can be processed on a daily basis through PRC custodian(s) according to its net amount of overseas subscription or redemption. Under the New Provisions, it is irrelevant to consider whether it is an open-end fund product, and a FII may appoint the custodian to handle the formalities for outbound remittance of relevant investment principal and profits with no lock-up period or limitations on frequency.

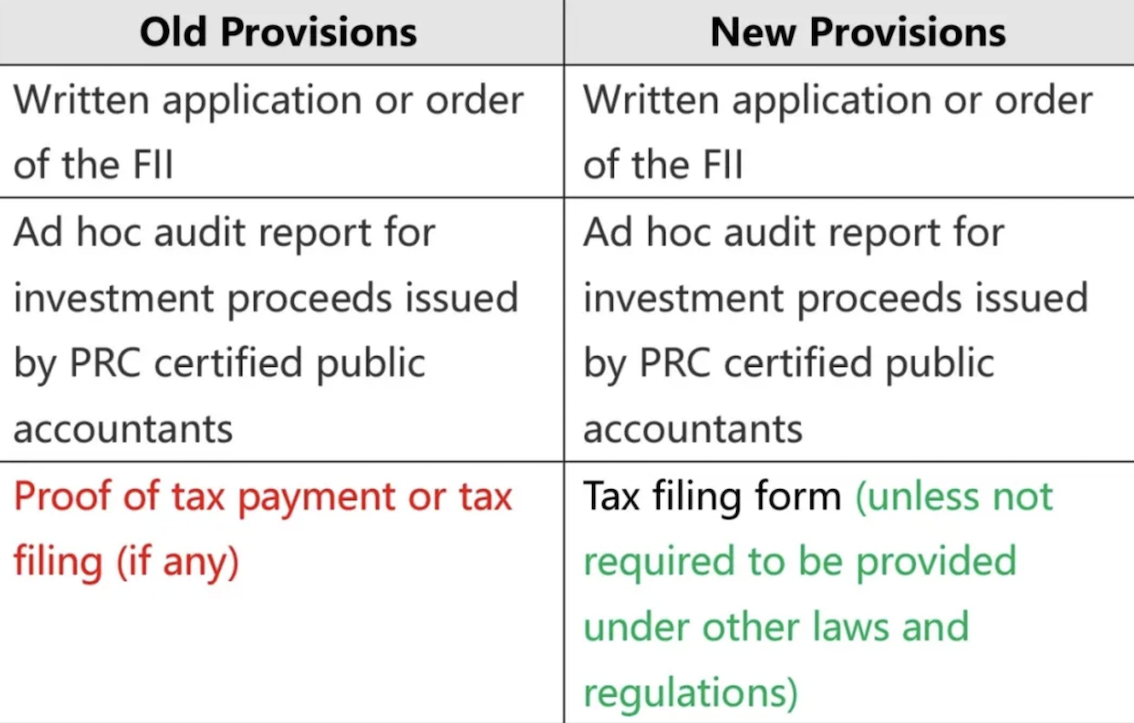

The New Provisions significantly simplify the materials required to be provided for outbound remittance of profits concerning open-end fund products, client money, and proprietary money.

The New Provisions no longer require a FII to provide documents including ad hoc audit report for investment profits issued by PRC certified public accountants, tax filing form when repatriating the realized accumulated profits, and an Undertaking Letter should suffice, which will significantly simplifies the formalities for repatriating funds out of China and ensures timely outbound remittance of the realized accumulated profits.

It is worth noting that:

(1) According to Policy Q&A No. 1, the profits remitted out by a FII by providing the Undertaking Letter shall be the accumulated profits after all losses of prior years have been made up. A FII may choose to provide the custodian handling the outbound remittance with an Undertaking Letter with respect to the portion of profits to be remitted prior to each outbound remittance of profits, or provide the custodian with a one-time Undertaking Letter with respect to the accumulated profits available for outbound remittance during a certain period of time (“Period of Validity”). Whatever the method a FII chooses, each Undertaking Letter may be issued to only one custodian.

If a FII provides a one-time Undertaking Letter, the Undertaking Letter shall specify the amount of accumulated profits to be remitted out through the custodian during the Period of Validity. In handling subsequent outbound remittance of profits for the FII, the custodian shall check the amount of each remittance against the amount of accumulated profits during the Period of Validity specified in the Undertaking Letter to ensure the amount of money remitted out would not exceed that specified in the Undertaking Letter.

(2) Simplification of the formalities for outbound remittance of realized accumulated profits of the FIIs does not impact the FIIs’ obligation to pay taxes according to laws and regulations.

3. Outbound remittance due to liquidation (including liquidation of products)

Compared with the Old Provisions, there is no material change in the New Provisions about the documents required to be provided for repatriation due to liquidation (including liquidation of products). However, the New Provisions add flexibility in terms of the requirements on the evidencing documents.

Under the Old Provisions, a FII shall realize the assets and close accounts within one month after the approval of its FII qualification is revoked, or its investment quota is cancelled. Similarly, the Consultation Paper provides that if the Securities and Futures Business License of a FII is revoked by CSRC, the FII shall realize its assets and close special accounts of the FII within one month. According to public feedback on the Consultation Paper, due to the needs of audit and tax clearance, a FII may not be able to realize the assets and close the account within one month after revocation of its business license by CSRC. The New Provisions adopt such public feedback and prescribe in Article 21 that after the business license of the FII is revoked, the period of time for realizing assets and closing accounts shall be thirty working days in principle, i.e., such period of time may be further extended in the practice.

IV. Financial Derivative Transaction

1. Broaden the scope of derivatives a FII is allowed to trade

One highlight of the New Provisions is broadening the scope of financial derivatives a FII is allowed to trade from the foreign exchange regulatory perspective. Under the Old Provisions, a FII could, only for the hedging purpose, conduct foreign exchange hedging and trade stock index futures. The New Provisions modify the scope of derivative transactions conducted by a FII in order to include conducting foreign exchange hedging and trading other financial derivatives which complies with relevant laws and regulations.

Though neither the New Provisions nor the Policy Q&A No.1 explicitly specify the scope of “other financial derivatives which complies with relevant laws and regulations”, we understand that those financial derivatives shall at least include the stock index futures contracts which a FII has been allowed to trade previously and “other financial futures contracts being listed and traded on China Financial Futures Exchange, and commodity futures and options contracts being listed and traded on recognized futures exchanges” that a FII is allowed to trade pursuant to the Measures for the Administration of Domestic Securities and Futures Investment by Qualified Foreign Institutional Investors and RMB Qualified Foreign Institutional Investors (Consultation Paper) and the Provisions on Issues Concerning the Implementation of the Measures for the Administration of Domestic Securities and Futures Investment by Qualified Foreign Institutional Investors and RMB Qualified Foreign Institutional Investors (Consultation Paper) (collectively “CSRC Consultation Paper”) issued by CSRC on 31 January 2019.

In addition to the stock index futures contracts, the treasury bond futures contracts are financial futures contracts being listed and traded on China Financial Futures Exchange.

Besides, the specific scope of “commodity futures and options contracts being listed and traded on recognized futures exchanges” will be published by futures exchanges after the approval of CSRC. Currently, the volume of China’s commodity futures market has been ranking top for years in the world, and CSRC, as of 2015, has launched the system of overseas traders’ participating in the domestic specific futures products, which allows overseas investors to participate in specific domestic futures trading through qualified domestic or overseas futures brokers. The broadening of investment scope of commodity futures and options for a FII would further facilitate a foreign institutional investor to invest in the domestic commodity futures market. It is worth noting that under the New Provisions and CSRC Consultation Paper, “hedging purpose only” is not a requirement for commodity futures and options trading, which means overseas fund managers whose main investment strategy is CTA (commodity trading advisor) strategy could also participate in China commodity futures market by applying for FII qualification.

It is worth mentioning that the Consultation Paper keeps the scope of financial derivatives a FII is allowed to trade under the Old Provisions unchanged, which is inconsistent with the scope of financial derivatives a FII is allowed to trade under CSRC Consultation Paper issued last year. Different guesses and doubts of the market participants on regulators’ requirements therefore arose at that time. The issuance of New Provisions reveals that the regulators have reached common understanding on broadening the investment scope of financial derivatives.

We understand that in addition to the financial derivatives above-mentioned, foreign institutional investors could also expect the open-ups of domestic financial derivatives, for example, the RMB IRS (interest rate swap) trading conducted on the China interbank market. Currently, RMB IRS trading is the main risk hedging tool a manager could use while investing in fixed income assets in China. According to the prevailing regulations, an overseas institutional investor conducting RMB IRS trading in China shall firstly file with PBOC for approval on participating in China interbank bond market, and sign National Association of Financial Market Institutional Investors (“NAFMII”) Master Agreement with its counterparty. We have noticed that there are overseas funds allowed to participate in the domestic RMB IRS trading through the so-called CIBM Direct channel. If foreign institutional investors via the FII channel are allowed to participate in the RMB IRS trading in the future, we believe that it will optimize the investor structure and promote the liquidity of China’s OTC derivatives market.

2. Foreign exchange derivative transactions

Pursuant to Article 16 of the New Provisions, a FII conducting foreign exchange derivatives in China shall still be for hedging purpose only and there shall be reasonable correlation between the derivative exposure and the investment risk exposure associated with the underlying domestic securities of the derivatives. It means that a FII conducting foreign exchange derivatives shall still satisfy the “real demand” principle.

The Policy Q&A No.1 further specifies, under the main reporter system built by the New Provisions, the method to implement real demand principle from the perspectives of rights and obligations and procedures.

Pursuant to Article 3 of the Policy Q&A No.1, a FII shall inform the main reporter its foreign exchange derivatives positions or overall positions, and the main reporter shall monitor whether the FII’s overall domestic derivative positions meet the real demand principle. It means that the main reporter shall ensure the FII’s compliance with the real demand principle while the FII shall also fulfill its obligation to provide relevant information to its main reporter. Besides, this provision seems to imply that the main reporter could rely on the information disclosure made by the FII to decide whether the FII’s foreign exchange derivative positions meet the real demand principle, without further conducting substantive examination. Furthermore, the Policy Q&A No.1 allows a FII to selectively inform the main reporter its foreign exchange derivative positions or overall positions with different counterparties, therefore meets its or its counterparties’ needs on keeping the details of transactions confidential.

Moreover, Article 5 of the Policy Q&A No.1 makes it explicit how to implement obligations regarding the payment and collection of funds and data reporting, under the scenario of conducting foreign derivative transaction between a FII and its counterparties other than its custodian(s). According to this Article, where a foreign exchange derivative contract matures, the custodian shall transfer the foreign currency or RMB to the account of relevant counterparty pursuant to the FII’s instruction, and receive the inward remittance of RMB or foreign exchange settled. Relevant counterparties shall report data under “foreign exchange purchase and sale within the foreign exchange account” to SAFE, and the custodian shall assist in providing information regarding foreign exchange account, etc., and the FII shall coordinate its counterparties with its custodian(s) on sharing information required to meet these regulatory and data reporting requirements.

At last, we also note that, regarding the adjustment frequency of foreign derivative positions, Policy Q&A No.1 keeps the policy of adjustment on a monthly basis in the Old Provisions unchanged, and only modifies the wording “within five working days from the end of each month” into “within five days at the beginning of each month”. It is inconsistent with the market’s interpretation that a FII could adjust its foreign exchange derivative position at any time when the Consultation Paper was issued last year. It seems that the regulator only moves this provision of adjustment frequency regarding foreign exchange derivative positions from a regulation to a Policy Q&A which is inferior in hierarchy, and therefore leaves more space and flexibility for any possible policy adjustment in the future.

V. Supervision and Administration

Although the process of inbound and outbound remittance has been greatly simplified under the New Provisions, a PRC custodian will still verify the authenticity and compliance of the receipts and payments of funds when handling inbound and outbound remittance for a FII and shall earnestly perform anti-money laundering and anti-terrorism financing obligations.PBOC and SAFE are more concerned about operational and post-operational oversight. Compared with the Old Provisions and Consultation Paper, the New Provisions delete the provision of “PBOC and SAFE may conduct macro-prudential administration according to the national economy and finance situation, supply and demand relationship in foreign exchange market, balance of international receipts and payments, etc.”

VI. Outlook

The New Provisions cancel the administrative requirements on domestic securities and futures investment quota of the FIIs, significantly simplify the material requirements on ad hoc audit and proof of tax payment (replaced by the Undertaking Letter) for outbound remittance of profits, and expand the investment scope of the FIIs (especially the financial derivatives). These measures would significantly increase money utilization efficiency of the FIIs, meet the risk management needs of the FIIs, further facilitate the FIIs participation in China’s financial market, and attract more foreign institutions to enter into China’s capital market through the FII channel.