(1) Roll Spread of Stock Index Futures Tracking

Calculated as the contract price of the current month minus the contract price of the following month, for the long roll, the positive calculation results are gains, the negative calculation results are losses. Code 00 in the figure represents the current month contract, 01 the next month contract, 02 the current quarter contract, 03 the next quarter contract.

(a)IF

Up to2020/8/20,the best roll plan is IF00-IF01,annualized roll yield in monthly term is5.95%。

Graph 1: IF Current month contract roll yield comparison (index point)

Graph 2: IF Current month contract roll yield comparison (annualized return)

(b)IH

Up to 2020/8/20,the best roll plan is IH00-IH01,annualized roll yield in monthly term is2.06%。

Graph 3: IH Current month contract roll yield comparison (index point)

Graph 4: IH Current month contract roll yield comparison (annualized return)

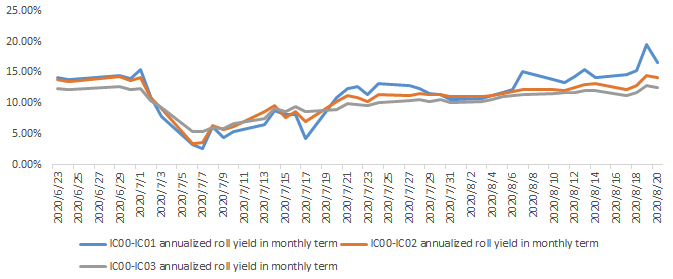

(c)IC

Up to2020/8/20,the best roll plan is IC00-IC01,annualized roll yield in monthly term is16.63%。

Graph 5: IC Current month contract roll yield comparison (index point)

Graph 6: IC Current month contract roll yield comparison (annualized return)

(2)Basis Tracking of Stock Index Futures

For long side, if the basis is positive, the change of the basis brings losses, and if the basis is negative, the change of the basis brings profits.

(a)IF

For long side hedge, up to 2020/8/20,all IF contracts were in discount. Here IF next month contract basis return annualized yield is 4.85%。

Graph 7: IF contracts basis

Table 1: IF basis return calculation

2020/8/20 IF00 IF01 IF02 IF03

Basis 3.65 -19.55 -84.15 -131.95

Basis return yield -0.08% 0.42% 1.80% 2.82%

Basis return annualized yield 4.85% 5.35% 4.81%

(b)IH

For long side hedge, up to 2020/8/20,all IH contracts were in discount. Here IH next month contract basis return annualized yield is 2.18%。

Graph 8: IH contracts basis

Table 2: IH basis return calculation

2020/8/20 IH00 IH01 IH02 IH03

Basis -1.13 -6.13 -23.53 -38.13

Basis return yield 0.03% 0.19% 0.72% 1.17%

Basis return annualized yield 2.18% 2.14% 1.99%

(c)IC

For long side hedge, up to 2020/8/20,all IC contracts were in discount. Here IC next month contract basis return annualized yield is 17.26%。

Graph 9: IC contracts basis

Table 3: IC basis return calculation

2020/8/20 IC00 IC01 IC02 IC03

Basis -6.59 -97.98 -317.39 -488.79

Basis return yield 0.10% 1.49% 4.81% 7.41%

Basis return annualized yield 17.26% 14.32% 12.65%